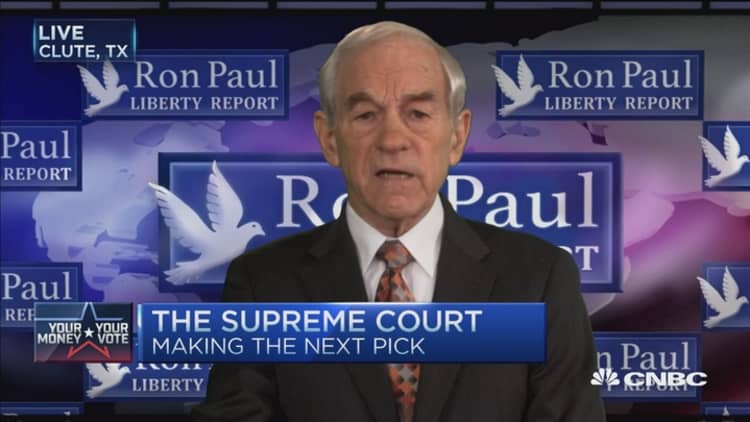

Longtime Fed critic and libertarian champion Ron Paul on CNBC Wednesday blasted the idea of negative interest rates.

"This whole idea of the Federal Reserve taking interest rates down to zero, then minus … this hurts people," Paul told "Squawk Box" in a wide-ranging interview that also included his views on the Republican presidential race.

In a speech Tuesday evening, Fed Vice Chairman Stanley Fischer said the U.S. central bank is looking at negative rates. But Fischer added there were no plans to use them.

The Bank of Japan unexpectedly adopted negative rates last month, joining a small group of central banks, including the European Central Bank, that charge lenders for parking their excess funds with them.

"The biggest problem we face is economic," Paul said, adding the U.S. economy is much worse off than politicians admit. He blames the Fed for keeping rates low for so long, making it tough for savers to get any return and forcing people into riskier assets.

The Fed increased rates for the first time in more than nine years in December, and at the time projected four more hikes this year. But the financial turmoil of 2016 has put that aggressive path in doubt among market participants.

Paul, who ran three times for president and served 12 terms as a U.S. congressman from Texas, said he advocates a return to a system where "the markets are important for setting prices, certainly the prices of money."