Oil prices are likely to remain under pressure this year as Saudi Arabia and Iran compete for market share in weak or slowing Asian economies, the editor of The Schork Report said Wednesday.

Stephen Schork said he does not necessarily agree with forecasts that oil will rebound into the $40s in the next 12 months, citing Saudi oil minister Ali Al-Naimi's comments on Tuesday that OPEC and non-OPEC members will not cut production.

"If you are long oil, get it through your head. Saudi Arabia is not going to throw you a life preserver," he told CNBC's "Squawk Box."

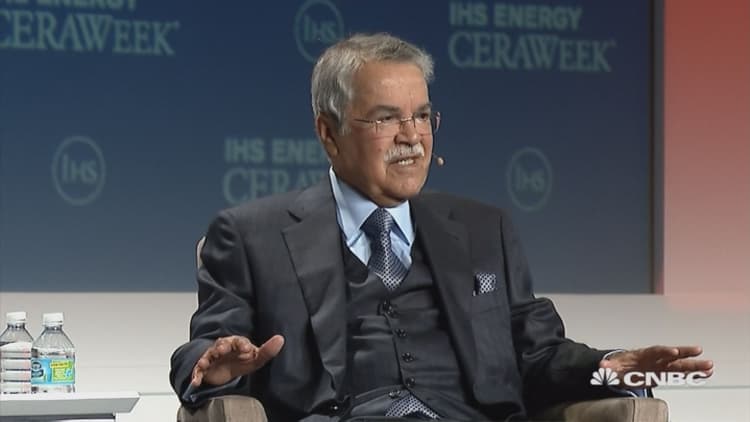

Al-Naimi's remarks at IHS CERAWeek in Houston sent oil prices spiraling on Tuesday after futures had risen in previous sessions, bolstered by a plan put forward by Saudi Arabia and Russia to cap output at January levels. That plan would be contingent on participation from OPEC and non-OPEC members.

Saudi Arabia in November 2014 led OPEC's policy of letting the market determine the oil price, rather than cutting production to boost prices.

Schork said it is simply unlikely that Saudi Arabia, the Middle East's dominant Sunni Muslim power, would take measures that would bolster its Shiite rival, Iran.

Iran recently ramped up crude exports after sanctions related to its nuclear program were lifted. The two countries also support opposing combatants in conflicts in Yemen and Syria.

"We are looking at the largest chasm between the Sunnis and the Shias within OPEC ever. Why would Saudi Arabia throw Iran a lifeline at this point?" he said.

Schork said he arrived at his conclusion by juxtaposing geopolitics with economics. Saudi Arabia and Iran are competing for available market share in Asia at a time when China is exporting deflation and Japan appears to be on the cusp of recession, he said.

In the more immediate term, Schork said he believes oil will test the $25 threshold once again as refineries enter their maintenance season and demand for crude falls.

Saudi Arabia can sustain the current policy for a long time because its break-even cost of producing the majority of its oil is likely below $10 a barrel, said Nansen Saleri, Quantum Reservoir Impact president and CEO.

However, he acknowledged that the Saudi economy, which is dependent on oil revenues, is suffering and the country has fallen into budgetary deficit.

"The pain threshold depends not only on the lifting cost but the total cost to the economy," he told "Squawk Box" on Wednesday.

Ultimately, the current low-price environment could last anywhere from six to 18 months, Saleri said. At some point, OPEC and non-OPEC producers must find a way to achieve a reasonable oil price.