Jim Cramer always appreciates the annual reports from Warren Buffett because he actually tells investors something.

In fact, if he were teaching a course in business, Cramer would use the Berkshire Hathaway annual report as his syllabus. In many ways, Buffett could charge a fortune for these insights.

"The simple fact is Buffett gives away a ton of information for free, and I can only think that is the case because he genuinely wants you to learn about business," the "Mad Money" host said.

Another year of free tutelage from the master, another year of investible takeaways. What more could you ask for?Jim Cramer

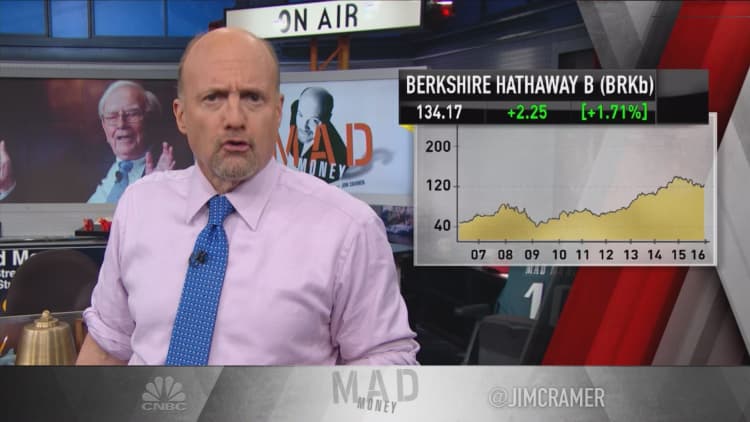

Cramer has been recommending Berkshire Hathaway since "Mad Money" began, and considered it counter-intuitive not to recommend the stock of the greatest investor of our time.

With this in mind, Cramer listed his top takeaways from the Oracle of Omaha's annual letter:

The first was that Buffett confirmed what was on a lot of investor minds — that the presidential election has created negativity in the perspective of the future for most Americans.

Read more from Mad Money with Jim Cramer

Cramer Remix: Bargain stores are winning stocks

Cramer: Scars from the Great Recession impacting stocks

Cramer: This punching-bag stock worth owning?

"This saturnine prism can translate into a lower price-to-earnings multiple for all stocks, and I feel even more strongly about that after reading his letter," Cramer said.

Second was that Burlington Northern was an underperformer in 2014, it managed to turn around thanks to more capital and tighter focus. While Buffett noted that 2016 will likely be a down year for the railroad, it did make Cramer think that other rails could be more investible.

It made Cramer want to buy Union Pacific and CSX, because they have less exposure to oil.

Third, Buffett's excitement over Precision Castparts made Cramer feel great about aerospace. It also prompted the "Mad Money" host to circle back to Alcoa because Buffett stated that Precision Castparts wants to do acquisitions. When Alcoa breaks itself up into two companies, the engineered portion of its business could match well to Precision Castparts.

And while Buffett disagreed with the style of opportunity that Kraft Heinz looks for — going after less productive enterprises and making them better, instead of buying best-of-breed and leaving it alone — Cramer felt secure with the position that his charitable trust holds for Kraft Heinz. Buffett still had high hopes for the company.

"Another year of free tutelage from the master, another year of investible takeaways. What more could you ask for?" Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com