"Safe-haven" sectors such as utilities and telecom have surged this year, but some traders believe the gains have reached their limits.

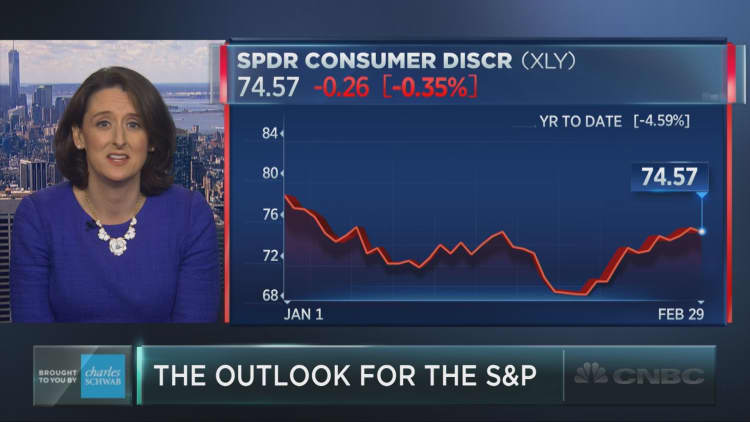

With the down 4 percent for the year, utilities and telecom have risen 7 and 9 percent, respectively. However, Erin Gibbs of S&P Investment Advisory said these high-dividend payers have become exceptionally expensive.

"Looking at a valuation perspective, these guys are definitely overbought," Gibbs said Monday on CNBC's "Trading Nation."

In the flight to safety this year, bond yields have fallen, making the high dividends paid by many utilities and telecom companies even more attractive to investors on a relative basis. But compared with other sectors in the S&P, utilities and telecom provide less growth potential and are trading at prices closer to analyst targets, Gibbs said. According to Gibbs, the utilities sector is currently trading at a higher price-to-earnings ratio than the broader S&P 500.

Given that the S&P's telecom sector only includes five stocks, Gibbs also advised buying individual high-yield dividend names rather than a broad sector.

Read More Investors develop a taste for junk

"At this point, when you look at the potential price appreciation you can get from other sectors versus these two, we really think your better returns are going to be outside of these safe stocks," she said.

Max Wolff, chief economist of Manhattan Venture Partners, agreed that the best defensive plays right now should be found outside of traditionally safe industries. He recommended taking a look at European aerospace and defense stocks, as well as health insurance stocks, which have been more badly beaten in the recent sell-off.

"I think you need to be defensive not by type, but by actual market circumstance," Wolff said Monday on "Trading Nation." "If you're overpaying to defend yourself, you're not that well-defended."

Want to be a part of the Trading Nation? If you'd like to call into our live Wednesday show, email your name, number, and a question to TradingNation@cnbc.com