It's all about the balance sheet for energy giants hoping to weather the storm of historically low oil prices, top analyst Doug Terreson told CNBC.

Super major oil companies like Exxon, Chevron and BP are Terreson's picks within the sector, with the war chest of cash to keep dividends safe and transform themselves through money-making purchases of smaller firms.

"These companies are in search of a better path forward," said Terreson, senior managing director and head of energy research at Evercore Group, an investment banking advisory firm. "With Exxon Mobil, they're in a superior position, and part of the reason why is they've done a better job of managing their capital than a lot of the other companies."

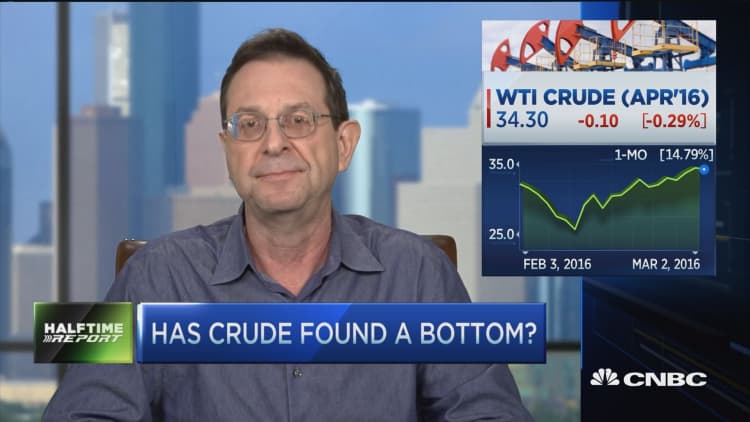

Despite oil prices languishing near $35 per barrel, shares of Exxon have managed to track near the general stock market, Terreson told CNBC's "Fast Money: Halftime Report" Wednesday. While the S&P 500 has lost about 6.5 percent over the past year, Exxon has lost 6.9 percent.

Exxon shareholder Barry James, who works for investing firm James Advantage Funds, has been a holder since 2004 doesn't plan to sell anytime soon.

James said that the company is "so well run" — referencing Exxon's low leverage compared to other multinational integrated oil companies, low impaired assets, low costs, and high profits on what they're pulling out of the ground — that it's still a "pretty solid holding."

"It's a company that I think can make it for the long haul, and I don't think we have to worry too much about the dividend yield at this point," James told CNBC's "Power Lunch" Wednesday.

Exxon affirmed Wednesday that it is dedicated to giving a growing dividend. Still, other energy firms known for dependable payouts, ConocoPhillips, Anadarko and BHP Billiton, have slashed dividends in recent weeks.

Exxon held an analyst day Wednesday where it shared details about reducing capital expenditures, cutting share repurchases and raising money in debt. That could mean acquisitions are on the horizon, Terreson said.

"We need consolidation in this industry before we can return to happier days," Terreson said.