If as expected Intercontinental Exchange launches a bid for the London Stock Exchange Group, it would mark a return to the city that is one of the pillars of the US company's $30 billion empire.

Executives and analysts alike say the LSE is officially "in play" after it revealed last week it was in talks about an all-share "merger of equals" with Deutsche Börse. On Tuesday ICE indicated it too may make a bid. "The LSE is a pretty hot target and is a massive foothold in European financial markets. Now the LSE is in play you can't afford not to be a bidder," said Niki Beattie, head of Market Structure Partners, a consultancy.

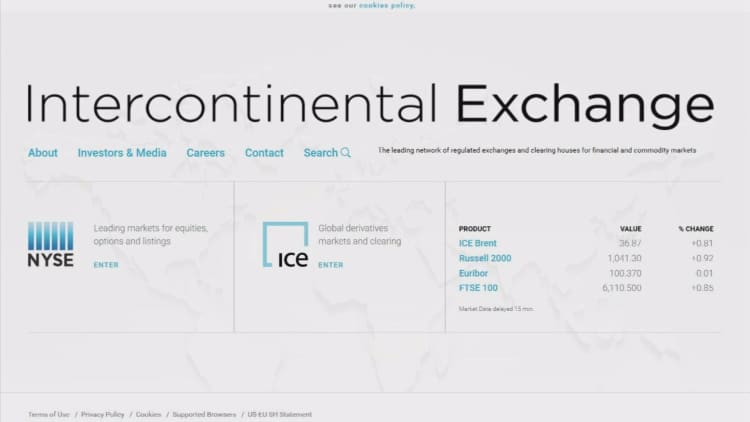

From the outset the 16-year old ICE has looked to the UK capital to help give its business scale, purchasing assets such as the International Petroleum Exchange and Liffe, whose names have disappeared under the ICE brand.

However, Atlanta-based ICE faces political and regulatory hurdles and may have to make a hefty offer if it is to walk off with London's biggest exchange asset.

Analysts said that the rationale for a bid is much the same as the one that drives the Deutsche Börse deal. Global regulations have forced banks to place billions of dollars of collateral and margin as insurance to back their derivatives trades. As a result, billions of dollars of capital are being held at clearing houses such as Deutsche Börse's Eurex, ICE Futures Europe and LCH. Clearnet. Bringing the clearing houses under one roof would allow customers to net their margin for swaps and futures.

Ms Beattie, a former bank head of electronic trading, thinks a deal for the LSE will happen after years of unconsummated bids. "I think that's why the banks won't lobby against it this time — the cost savings [from netting margins] will be too great for banks exhausted by regulatory issues."

Adding the LSE would make ICE London's dominant market infrastructure. Besides Liffe and the IPE, it has also bought emissions trading platform Climate Exchange, energy trading platform Trayport and also opened the first new clearing house in London in more than 100 years, in 2008.

Jeff Sprecher, ICE chief executive, has been a vocal critic of several of Europe's planned markets regulations, but his interest in the LSE indicates the continent is still his target.

However, the LSE and Deutsche Börse have an agreement and have been working for several weeks on getting political and regulatory support from London, Berlin and Brussels. They want to use their deal as a bridge to Europe and help kick-start regional economic growth and lessen the reliance on banks for corporate fundraisings. "The company is continuing its merger talks with LSE with no change," Deutsche Börse said in a statement.

More from The Financial Times :

China's state-owned zombie economy

Amazon's grocery deal with Morrisons is only the beginning

Nato accuses Russia of 'weaponising' immigrants

Moody's, the credit rating agency, said an LSE-Deutsche Börse tie-up would be positive for bondholders and a credible rival to CME and ICE, "albeit at lower relative margins".

But ICE's approach came as investors began to anticipate a competing bid, either from ICE or Chicago's CME Group, the ICE rival that is closely watching developments.

LSE shares "had begun to trade above the implied level of the [Deutsche Börse] agreement, after adjusting for dividends," noted Owen Jones, an analyst at Citigroup.

CME is also rumored to be looking at an approach but declined to comment. People close to the LSE said a US approach would likely be a different type of bid, "with a proper change-of-control premium".

"If we assume 50 per cent of the LSE's expenses could be eliminated and each transaction was structured as an all-stock deal, we calculate ICE could pay up to £34 while CME could pay up to £44 [for LSE]," said Christopher Harris, an analyst at Wells Fargo.

A bidding war would be bad news for Deutsche Börse, Mr Jones said. "Its balance sheet is stretched already, judged on a gross debt to earnings before interest, tax, depreciation and amortisation basis . . . and a revision to its offer would see either a higher proportion of the combined entity go to LSE shareholders, or it would involve an equity raise, we think."

Inevitably, the size and diversity of the LSE's business — from indices, data, clearing and trading, creates potential issues for all bidders. Nevertheless European exchange executives are hoping it could mean parts of the LSE are spun off to ease the deal, such as Clearnet, the French clearing house and Millennium IT, the LSE's technology business. Euronext, which ICE spun off two years, ago is understood to be interested in purchasing Clearnet.

Shareholders, who may be asked to decide between two different bids, may take their lead from Xavier Rolet, the LSE chief executive, who could lose out come what may.

"The fact that Xavier wanted to go put a whole different complexion on the [DB] bid. That was very disconcerting for us — disappointing and surprising," said one top 10 shareholder. "He is the one that knows the market."

Equally, shareholders may see a US bid as more disruptive. "Perhaps that indicates that the proposed merger of equals with two open access derivatives groups, one in London, one in Paris, could be quite compelling," said Jake Pugh, a former LSE consultant.