Most major indexes are weighted based on market cap, meaning that big-company components can swing the index more than the little ones. For example, a 20 percent move in Apple can shift the entire index by more than half a percent.

An equal-weighted index, on the other hand, treats all the companies the same in terms of how they can influence the market. The argument goes that equal weighting isn't as susceptible to individual blips in particular companies.

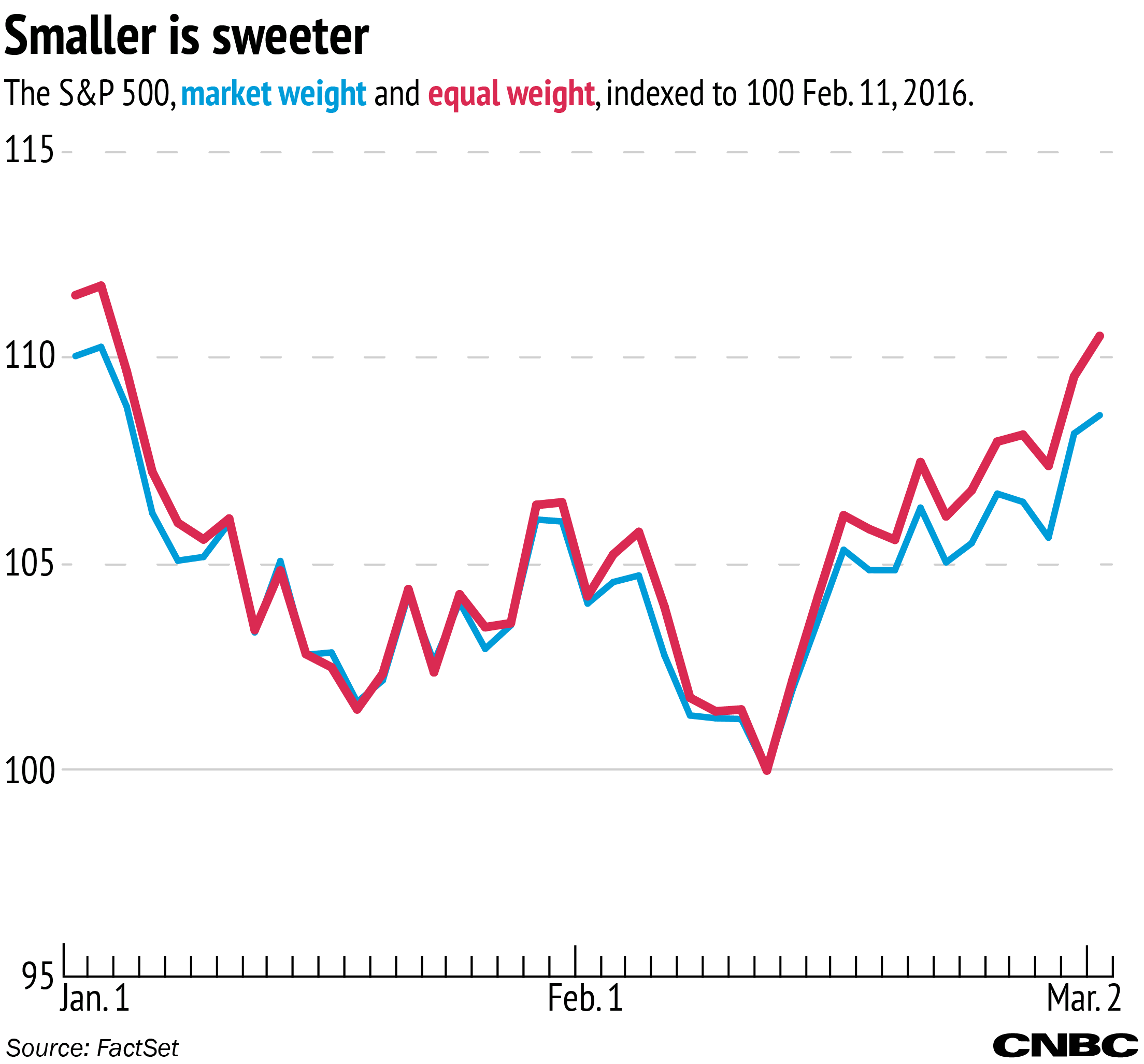

The equal-weighted index is up more than 10.5 percent since the Feb. 11 low. That beats the market by almost 2 full percentage points. The Russell 2000, a standard measure of small-cap stocks, is up 11.7 percent in that same time.

Wednesday was a good example of that, when the equal weighted index beat the true index by nearly half a percent.