Jim Cramer knows that many think that streaming video is the way of the future, and younger generations are cutting the cord to their cable boxes. But that doesn't mean everyone should just give up on all things cable in the investing world.

"When you look past all of the glib headlines about cord cutting and actually check out what is happening with the higher quality cable stocks, it is clear that we are dealing with a very different story … reports of cable's death have been greatly exaggerated," the "Mad Money" host said.

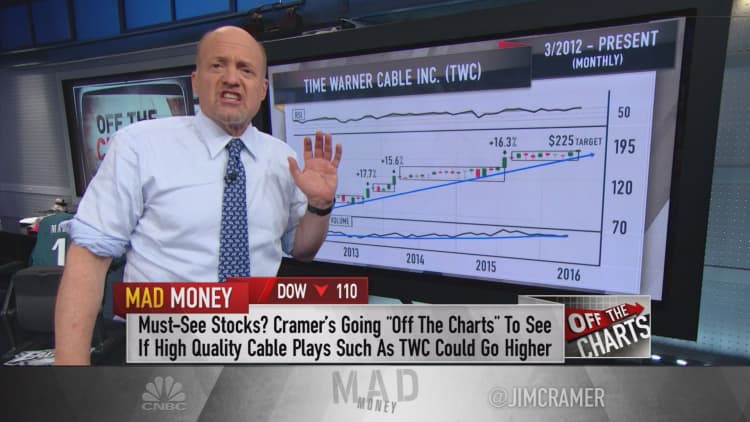

To get an inside look at what the charts could say about higher quality cable companies like Time Warner Cable, Cramer turned to Tim Collins. Collins is a technician and colleague of Cramer's at RealMoney.com.

When Collins looked at the charts, he found that Time Warner is actually on of his most favorable long-term charts out there.

"When you actually look at the monthly chart of a stock like Time Warner Cable, it is very clear that when it comes to the death of cable, these guys obviously haven't gotten the memo," Cramer said.

You can read all the stories about cord cutting you want, that doesn't change the fact that this is an incredibly bullish long-term chartJim Cramer

The stock has moved higher year after year, and currently it is less than $1 from all-time highs. Even though the stock has an occasional pullback, Collins found that they tend to be contained. Whenever the stock breaks out beyond its previous ceiling of resistance, that ceiling becomes the new floor of support.

Read more from Mad Money with Jim Cramer

Cramer Remix: Beware the Fed's impact here

Cramer: Oil patch could save itself, as banks did

Cramer: The shake-out in restaurants has begun

The process of containment and then breaking out has occurred for years, and Collins noted that the last three breakout moves have all taken place within a single month's time, and the stock roared as much as 17 percent higher.

Then the challenge becomes catching the next breakout before it happens. Collins believes that Time Warner Cable could be set up for another terrific upside move.

Additionally the Relative Strength Index, which is an important momentum indicator, has remained at high levels for a long time. At the same time, Collins saw that the On Balance Volume — a tool used to measure buying and selling pressure — has been steadily trending higher for the past three years. Collins had no reason to think this is going to change.

"In short, you can read all the stories about cord cutting you want, that doesn't change the fact that this is an incredibly bullish long-term chart," Cramer said.

However, Collins did have some concerns. If the stock closes the week below $190, which would place the stock back into the trading range it was stock in last summer. The stock still has an open gap to fill from the last upside breakout, and if that gap is filled, Collins said the stock could go back down to $170.

While he did not think this was much of a concern right now, Collins recommended watching the $190 level and start worrying that the stock could fall if it goes below that level.

Overall, Collins still found Time Warner Cable to be one of the most favorable long-term charts of any large-cap stock that he follows. So, despite the chatter surrounding the death of the cable industry, Collins thinks the downside is well-defined, and the stock could fly $25 to $35 from its current price.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com