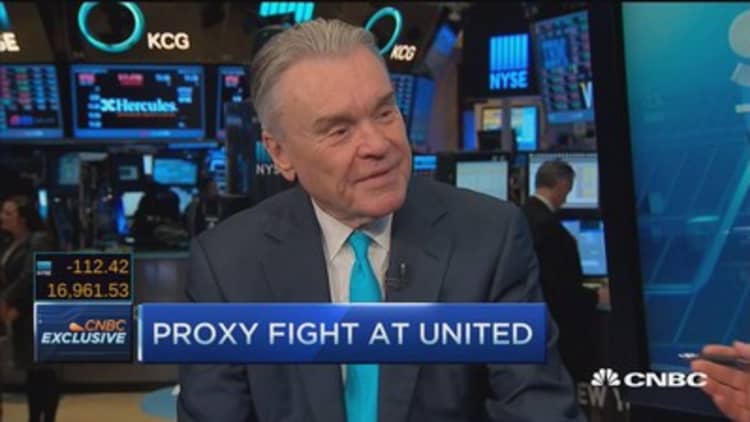

Former Continental Airlines CEO Gordon Bethune on Tuesday criticized United Continental's board for conducting business in a "country club atmosphere." He made the comment after two hedge funds said they will try to force the board to appoint him chairman.

The firms, PAR Capital Management and Altimeter Capital, said they will also nominate five other candidates to the board.

Bethune was Continental's CEO until 2004. The airline merged with United in 2010.

"As long-term United stockholders, we have been greatly disappointed with United's poor performance and bad decisions over the last several years," said Brad Gerstner, CEO of Altimeter.

Bethune agrees with Gerstner's assessment, telling CNBC's "Squawk on the Street" that the board is in need of a member who understands the airline business.

"I do know the front end from the back of the airplane and that would be a novel experience for a board member at Continental or United," Bethune said. He went on to criticize the board for failing to lead United to success.

"The board has got a kind of country club atmosphere," he said, adding that the board "obviously hasn't been paying attention, hasn't set the right goals, frankly hasn't followed good governance processes and procedures."

In response to the situation, Henry Meyer, United's nonexecutive chairman, said: "We are deeply disappointed that after United attempted to engage in a constructive, good-faith dialogue with PAR and Altimeter, repeatedly communicated our willingness to make meaningful changes to our board ... PAR and Altimeter have unilaterally taken this hostile action with no concern that a proxy fight could distract the Company from executing [CEO Oscar Munoz's] strategic plan."

UAL's stock was down less than 1 percent midafternoon Tuesday.

PAR Capital and Altimeter, which have a collective 7.1 percent stake, made the announcement in a letter two days after United said Munoz would return to work full time next Monday. Munoz had a heart transplant in January, three months after suffering a heart attack.

"They are nominating six director candidates, which we believe is designed to put their nominees in control of the board and our company's future. This situation shouldn't change your focus," Munoz said in a memo to employees Tuesday. "Our focus must remain on running a great airline that all of us are proud to work for and that our customers choose to fly."

In the letter, the firms also cited United's "knee-jerk response to shareholders' efforts" by adding three new members to the board on Monday "while simultaneously expanding its Board size from 12 to 15 directors" as another reason for their nominations.

"We are generally patient investors. We certainly are neither short-term traders nor activists. We have not made this difficult decision lightly, but after thorough, serious and objective analysis, we feel compelled to act," Altimeter and PAR said.

Bethune currently serves on the boards of Prudential, Honeywell and Sprint. He told CNBC on Tuesday that he intends to remain on Sprint's board, but will leave the others. He intends to serve as United's chairman for only two years, adding that he doesn't want to be in the business any longer than that.

Another element that factored into their decision included United's "Clear Record of Sustained and Substantial Underperformance."

"Despite premier, industry-leading strategic assets — such as significant scale advantages, strong brand recognition, hubs in key business markets, and membership in the largest global airline alliance — United has been the worst performing U.S. airline stock over the last five years," Altimeter and PAR said.

Over the past five years, United shares have gained nearly 128 percent, while the S&P has risen 52 percent. But shares of rival Delta have risen more than 300 percent during the period and Southwest Airlines' has gone up 224 percent.

Bob Crandall, former president and chairman of American Airlines, said Tuesday that expectations for airlines have risen substantially. "The consequence of that is activists saying let's see if we can get some pros in there, and maybe they can help United do a little better," he told "Squawk Box."

"I think the activity itself is probably a consequence of United … being in an unsteady situation for a long time," he said. "They've never gotten that quite right since the merger."

However, Bethune agrees with Altimeter and PAR's read on United's potential.

"They should be in first place instead of fourth or fifth place. United has the best employees, the best fleet and the best route system," he said. "If you're in a horse race and you're in fourth place, you're not winning."

— CNBC's David Faber and Phil LeBeau contributed to this report.