Business icons Jack Welch, Meg Whitman and Carly Fiorina all had negative things to say about Donald Trump this week, and media reports said tech CEOs including Tim Cook and Elon Musk held a secret meeting to discuss how to stop the GOP front-runner.

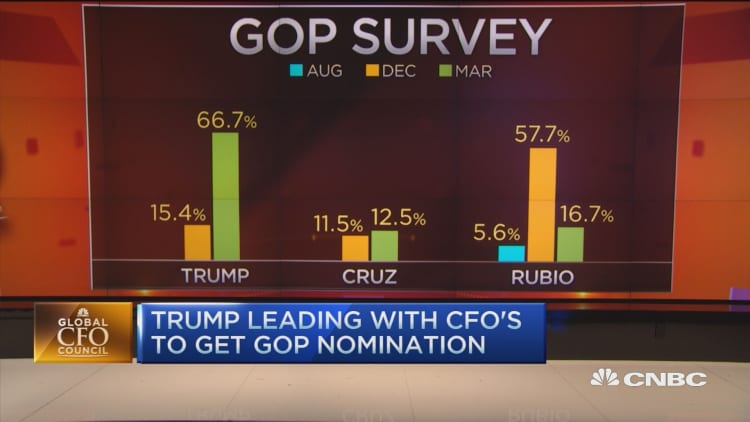

But do you think any of this will slow The Donald? U.S. CFOs don't. Across a wide range of industries, CFOs have conceded that Trump will be the GOP candidate, according to the latest CNBC Global CFO Council survey, conducted between Feb. 25 and March 8.

It's the first time since the GOP race began that a majority of U.S. CFOs taking the survey said Trump would prevail in the battle for the Republican nomination.

A little under 67 percent of CFOs say Trump will maintain his lead, up from 15.4 percent who picked Trump in December, before the start of the primary voting season. Marco Rubio at 16.7 percent was second, followed by Ted Cruz's 12.5 percent.

On the Democratic side, it remains nearly unanimous, with all but one of the 24 CFOs saying Hillary Clinton will be the Democrats' nominee. The one holdout chose "Don't know" over Bernie Sanders.

Just under 46 percent of U.S. CFOs say corporate tax reform is the most important issue to their companies this election season; 12.5 percent say Federal Reserve policy is the most important issue.

Apple vs. Uncle Sam

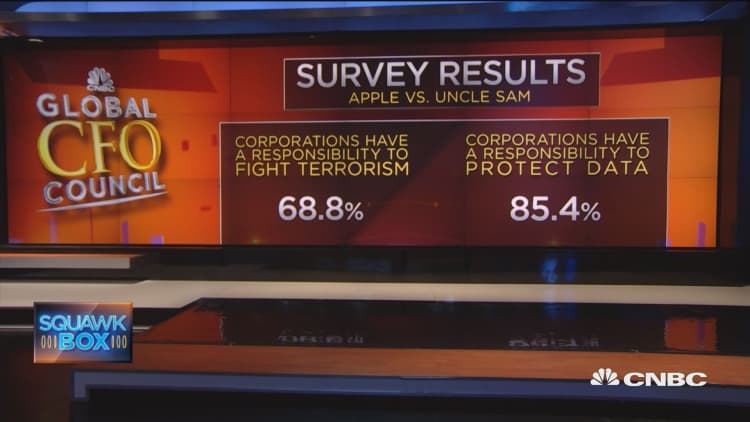

The ongoing confrontation between Apple and the FBI over whether or not Apple should unlock the iPhone used by a San Bernardino terror attacker has sparked a complicated public debate over digital privacy. The results of the latest CNBC Global CFO Council poll reflect that complexity.

More than two-thirds of worldwide CFOs surveyed (68.8 percent) agree that corporations have a responsibility to fight terrorism. But at the same time, 85.4 percent agree that corporations have a responsibility to protect customer data and keep it private.

(Note to chart: Sort results above by question.)

Those results may help explain why CFOs were split on whether or not Apple should comply with the FBI: 45.8 percent agree Apple should unlock the phone, while 22.9 percent disagree.

The macro view

Council members weighed in on a variety of issues facing the global economy, including oil prices and monetary policy. For the first time since CNBC launched the Global CFO Council in 2013, CFOs from all three global regions (U.S, EMEA and APAC) received the same set of survey questions. In most cases, responses were consistent across the three regions.

The one major exception was a question about the largest external risk factor facing the CFOs' companies.

U.S. CFOs are most likely to say consumer demand (41.7 percent) or cyberattacks (20.8 percent) is the biggest external risk. In Europe, 26.7 percent of CFOs say "emerging markets" pose the biggest risk to their firms, and an additional 20 percent single out China. In Asia, China is overwhelmingly seen as the biggest risk to business by CFOs who responded to the survey.

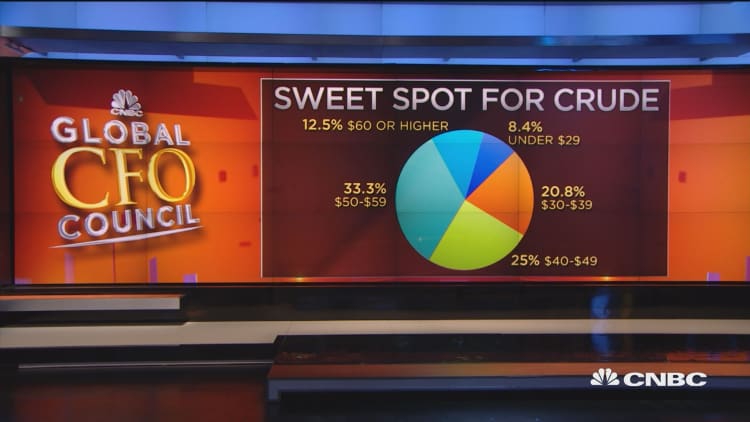

On oil, most CFOs say prices are still too low. Just under 71 percent say the ideal price of oil for their companies is above $40 per barrel. Only 8.4 percent prefer prices below $30.

The Fed: Will it or won't it?

Global economic jitters and stock market volatility have lowered expectations that the U.S. Federal Reserve will aggressively raise interest rates this year. One quarter of CFOs say the Fed won't raise rates at all in 2016, while 39.6 percent expect one rate hike.

Complete survey results below:

(Note: 48 of the 103 current members of the CNBC Global CFO Council responded to this quarter's survey. Members represent a diverse mix of public and private companies from around the world, with more than $2 trillion in market capitalization.)