A British breakaway from the European Union this summer will do little damage to the country's business ties with the rest of the world, according to a new survey conducted by CNBC.

Chief financial officers (CFOs) from some of the world's biggest firms were largely sanguine on the outcome of a "Brexit" and how that could affect any current or future trading conditions with the island nation.

Over 70 percent of global CFOs - across a wide range of industries - said there would be "no change" on their perspective on how likely they would be to do business with the U.K. in the event of an exit.

However, 14.6 percent of respondents said they would be "slightly less likely" to do business with the country and 2.1 percent said they would be "significantly less likely." Conversely, 2.1 percent said they would be "slightly more likely" to form ties with a breakaway nation.

A fierce debate is heating up in the U.K. on whether the country should leave the regional 28-country bloc and regain some national sovereignty or whether it should remain within a reformed European Union.

A referendum due on June 23 has seen a range of business leaders and institutions come down on either side of the argument. On Thursday, world-famous physicist Stephen Hawking warned that a Brexit would be a "disaster for U.K. science." Last month, bosses from more than a third of Britain's 100 largest companies signed a letter to The Times newspaper calling for the country to stay in the EU.

Pro-Brexit campaigners include the heavyweight politician Boris Johnson, who is currently London mayor. And the upcoming vote has even drawn in Queen Elizabeth who is currently fighting claims in The Sun newspaper that she had previously privately voiced some Euroskeptic views.

Fresh data on Friday provided more fuel for the Brexit campaigners, according to Kallum Pickering, a senior U.K. economist at Berenberg, with the U.K. balance of trade for goods with the European bloc widening in January.

"This will play nicely into the hands of the 'out' camp in the lead up to the EU referendum. But this is an example of another misdirected argument that somehow the EU needs the U.K. more than the U.K. needs the EU," he said in a note.

The latest CNBC Global CFO Council survey, was conducted between February 25 and March 8. For the first time since CNBC launched the survey in 2013, CFOs from all three global regions (U.S, EMEA and APAC) received the same set of survey questions

Global economic jitters and stock market volatility have lowered expectations that the U.S. Federal Reserve will aggressively raise interest rates this year.

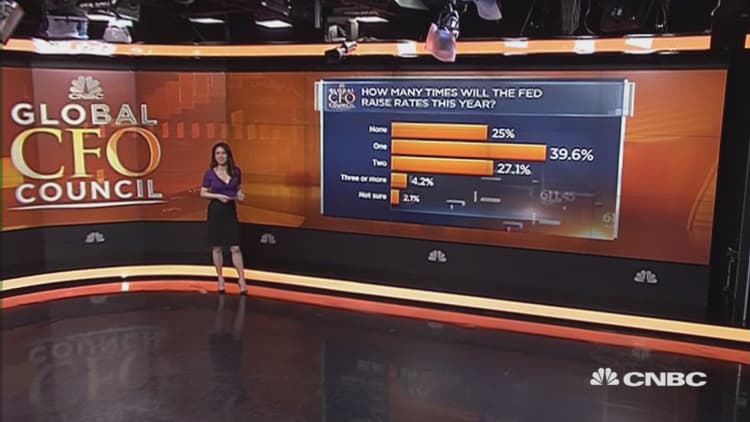

One quarter of CFOs say the Fed won't raise rates at all in 2016, while 39.6 percent expect one rate hike. The Fed is due to make a rate decision at its meeting this week, with market participants largely seeing little chance that it will add to the hike it announced back in December.

In most cases in our survey, responses were consistent across the three regions. The one major exception was a question about the largest external risk factor facing the CFOs' companies. U.S. CFOs are most likely to say consumer demand (41.7 percent) or cyberattacks (20.8 percent) is the biggest external risk.

In Europe, 26.7 percent of CFOs say "emerging markets" pose the biggest risk to their firms, and an additional 20 percent single out China. In Asia, China is overwhelmingly seen as the biggest risk to business by CFOs who responded to the survey.

Complete survey results below:

(Note: 48 of the 103 current members of the CNBC Global CFO Council responded to this quarter's survey. Members represent a diverse mix of public and private companies from around the world, with more than $2 trillion in market capitalization.)

—CNBC's David Spiegel contributed to this article.