The Dow Jones industrial average closed in positive territory for 2016 on Thursday, as gains in materials and industrials led stocks higher. A rise in oil prices and a positive view of the Fed's Wednesday announcements also helped stocks.

"The market expectations and the Fed are finally aligned," said JJ Kinahan, chief strategist at TD Ameritrade.

"We've hit the reset button. We're back to where we can reset. Everybody's agreed, from Fed policymakers to those who are trading the interest rate products," he said, noting focus has shifted to earnings season and "there's a lot of hope" given FedEx's better-than-expected quarterly report.

The Dow transports closed up 2.98 percent, topping its 200-day moving average for the first time since May 8, 2015 as FedEx had its best day since 1993 with gains of 11.8 percent.

U.S. crude oil futures settled up 4.5 percent at $40.20 a barrel, its highest settle of the year so far.

Traders also attributed some of Thursday's gains to Friday's options expiration.

"I think (the rally Thursday) is probably the recognition the Fed is responding to the weaker environment and they're not going to tighten as quickly," said Jack Ablin, chief investment officer at BMO Private Bank.

Still, he remained cautious on the recent rally given historically high valuations in the S&P 500. The recovery year-to-date "is just a reminder of how expensive the market is," he said. "When the market falls during earnings season it just shows fundamentals just can't support prices."

Materials and industrials gained about 2 percent each to lead S&P 500 advancers, with energy the third-best performer. Health care was the only decliner, off about 1 percent. The S&P 500 briefly erased losses for 2016 in afternoon trade but ended 0.16 percent lower year-to-date.

The Dow Jones industrial average ended 0.32 percent higher for the year so far with Thursday's closing gains of about 155 points after briefly adding 203 points intraday. Boeing, Goldman Sachs and IBM were the top contributors to gains.

At the intraday low of this quarter on Jan. 20, the Dow was down 11.33 percent or nearly 2,000 points (1,974 points to be exact) for the year.

"Basically this is an FOMC outcome that was more dovish than some had anticipated in the near term," said Stephen Freedman, senior investment strategist at UBS Wealth Management Americas. He expects stocks to remain range-bound over the next few months.

"I think it's marginally supportive. If the Fed had been oblivious to everything the market has been concerned about, that would have been concerning because it shows they are out of touch with reality," he said.

The major averages opened lower and held mixed in midday trade before extending gains.

The Nasdaq composite underperformed the Dow and S&P as Apple closed a touch lower and the iShares Nasdaq Biotechnology ETF (IBB) ended down 1.2 percent.

"It's a bit cautious here because we took out a key level yesterday in the S&P and a resistance level, 2,025," said Peter Coleman, head trader at Convergex. "You're at pretty lofty levels here."

On Wednesday, U.S. stocks rose after the Fed kept rates unchanged and lowered its projection to two hikes in 2016, from four. The Dow Jones industrial average and S&P 500 both topped their 200-day moving averages to close at their highest of the year so far, with the Dow at 17,325 and the S&P at 2,027.

Read MoreStreet to take second look at Fed

Lance Roberts, chief investment strategist at Clarity Financial, said the big question is "whether or not this market can stay above the 200-day moving average, or did yesterday's Fed announcement mark the unwind of this recent rally."

In economic news, leading indicators for February rose 0.1 percent.

January's Job Openings and Labor Turnover Survey showed a separations rate of 3.4 percent versus a revised 3.6 percent in December, according to StreetAccount.

Weekly jobless claims came in at 265,000. The March Philly Fed index was 12.4 versus minus 2.8 for February.

Fourth-quarter current account data showed a deficit of $125.3 billion.

Treasury yields were mostly lower, with the 10-year yield at 1.90 percent. The Treasury yield held flat, near 0.86 percent.

Gold extended sharp gains seen in Wednesday's post-settle electronic trade, settling at $1,265 an ounce, up $35.20.

The U.S. dollar index was off more than 1 percent and touched its lowest level since October 2015.

The euro topped $1.13 to hit its highest since Feb. 11.

The U.S. dollar hit a low of 110.65 against the yen, the lowest since October 2014. The yen was near 111.47 yen against the greenback in the close.

The iShares MSCI Emerging Markets Index ETF (EEM) closed up 2.2 percent and is on pace for its best quarter since the second quarter of 2014.

Major U.S. Indexes

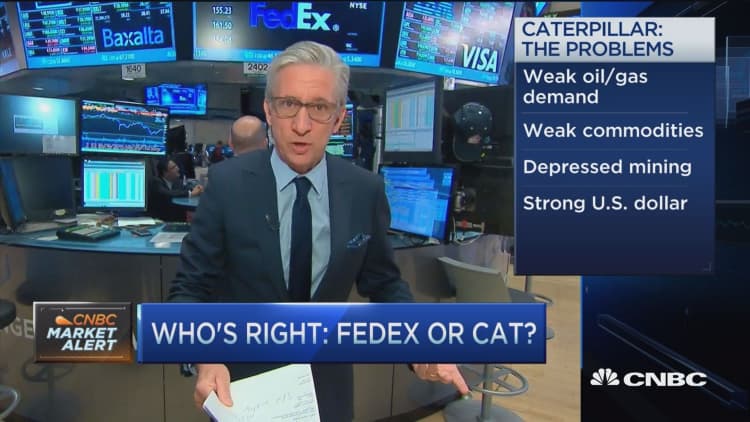

In corporate news, Caterpillar cut its first-quarter earnings and revenue guidance, but said it remains comfortable with its prior full-year forecast. The stock closed up 2.1 percent.

Read More Early movers: CAT, LE, FDX, MDLZ, NKE, C, GOOGL, GSK, VRX, ODP & more

The Dow Jones industrial average closed up 155.73 points, or 0.90 percent, at 17,481.49, with General Electric leading advancers and Wal-Mart the greatest laggard.

The closed up 13.37 points, or 0.66 percent, at 2,040.59, with materials leading nine sectors higher and health care the only decliner.

The Nasdaq composite closed up 11.01 points, or 0.23 percent, at 4,774.99.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, held above 14. Earlier, the VIX fell below 14 to hit its lowest since November.

About five stocks advanced for every decliner on the New York Stock Exchange, with an exchange volume of 1.0 billion and a composite volume of about 4.5 billion in the close.

—CNBC's Robert Hum contributed to this report.

Correction: This story has been updated to reflect an adjustment to StreetAccount's figures on December's separations rate in the JOLTS report.

On tap this week:

Thursday

4:30 p.m.: Fed balance sheet/Money supply

Friday

Quadruple Witching

Earnings: Tiffany

9 a.m.: New York Fed President William Dudley speaks

10 a.m.: Consumer sentiment

10 a.m.: Atlanta Fed business inflation expectations

11 a.m.: Boston Fed President Eric Rosengren speaks

1 p.m.: Oil rig count

1:30 p.m.: St. Louis Fed President James Bullard

*Planner subject to change.

More From CNBC.com: