Stocks have made a major comeback over the last month, but some traders say that one of the leading groups in the recent rally is set to run out of steam.

The S&P 500 energy sector has been leading the market gains, rising 8 percent in March as the broader S&P has risen 5 percent. Unfortunately, as energy stocks have gone up in price, they've skyrocketed in valuation, according to Erin Gibbs of S&P Investment Advisory.

Gibbs said the S&P energy sector looks extremely expensive given an expected 60 percent earnings contraction for 2016, trading at a price-to-earnings ratio of 70 times expected forward earnings. This is in steep contrast to the S&P 500, which is trading at about 17 times forward earnings.

While a pop in oil prices may drive the sector higher, Gibbs said dismal profits and high amounts of debt will continue to weigh on energy companies longer term.

"I have some real concerns about these companies' being able to trade at these valuations, even if gas and oil recover," she said Wednesday on CNBC's "Power Lunch."

Read More When markets get scary, panicking is smart: Yale profs

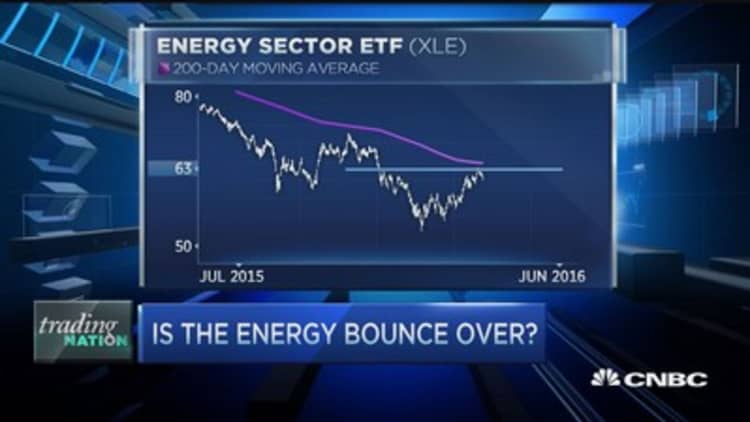

Looking at the SPDR energy sector ETF (XLE), Todd Gordon of TradingAnalysis.com agreed that the levels at which energy stocks are trading appear unsustainable.

Among the technical warning signs, Gordon noted that energy stocks have reached a 62 percent retracement level at which stocks should see technical resistance. Another potential concern is the ETF's inability to cross above its 200-day moving average.

And with energy the best performing sector of the over the past month, Gordon said potential weakness in energy names may translate into trouble for the broader market as well.

"It looks like the leader in this market has failed," he said Wednesday in a "Trading Nation" segment. "We could see some downside to come."

Want to be a part of the Trading Nation? If you'd like to call in to our live Wednesday show, email your name, number and a question to TradingNation@cnbc.com.