Fed Chair Janet Yellen attempted to reassure markets that the U.S. central bank will move cautiously with further rate hikes, pushing back at recent hawkish comments from other Fed officials. But the Fed chair also managed to unleash a backlash from some of Wall Street's more often staid economists.

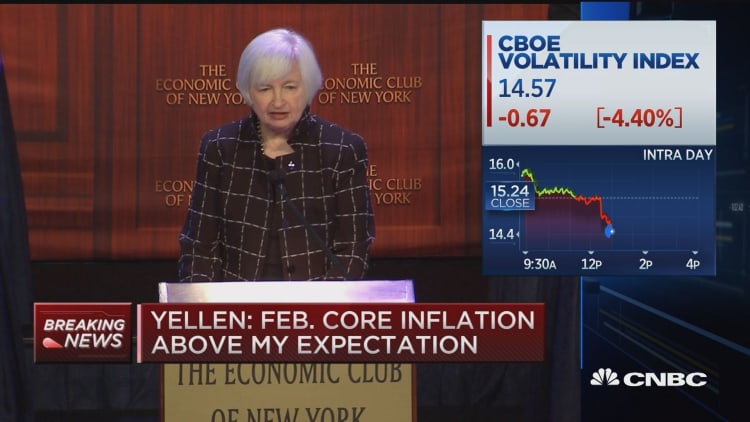

Yellen, speaking to The Economic Club of New York, said that it is appropriate to proceed with caution in moving policy, and that economic and financial conditions are somewhat less favorable than in December when the Fed raised interest rates for the first time in nine years.

But some Fed watchers thought Yellen's message was murkier than usual and raised doubts about the central bank's forecasts and monetary path.

"Janet Yellen gave her audience limited lip service to 'baseline' projections and expectations for dual mandate improvement and rate normalization, but carpet-bombed her audience with possible downside caveats. In so doing, she created the distinct impression that she had little confidence in the Fed's baseline outlook," wrote Ward McCarthy, chief financial economist at Jefferies, in a note.

Read MoreYellen: Economic readings mixed, appropriate to be cautious

Citigroup economists cut back on their rate hike expectations after the speech and now expect just one rise this year, in either September or December. And Amherst Pierpont's chief economist, Stephen Stanley, said the chair's speech revealed herself to be a "radical dove," in a note he titled "Janet Yellen jumped the shark."

"In the past, she and I might have looked at a glass of water and disagreed about whether it was half full or half empty," wrote Stanley. "Today she took the partially full glass and dumped most of the water out and defiantly declared the glass mostly empty. Her assessment of the economic and policy outlooks is well out of step with most of her colleagues on the FOMC as well as most private sector economists."

Yellen's appearance was the first since several Fed officials suggested last week that the central bank should start to move more quickly to raise rates, even as early as April.

Those comments were viewed as surprising and a sign of disagreement within Yellen's Fed, particularly after the FOMC issued a dovish statement after its March meeting.

"There really wasn't any new direct information content. We know they're going slowly. We know they're being cautious. We know they're being flexible. What was new was the weight of risks," said McCarthy. "She heaped them on. She came off as being uncertain about the outlook for growth, inflation and therefore monetary policy. ... If the price of everything goes up then she'll be convinced they've finally beaten back deflation."

Markets took her words as dovish and stocks rose, the dollar weakened and bond yields fell, particularly the Fed-sensitive two-year note yield. That note slipped to 0.78 percent from 0.84 percent before her speech. Bank stocks fell with declining yields.

"Curiously, for a central bank presumably in the middle of a tightening cycle, Yellen's speech focused more on downside risks that those to the upside," wrote Dana Saporta, director of economic research at Credit Suisse. Saporta said she expects Yellen would have been just as dovish had the other Fed officials not called for rate hikes.

Traders also focused on her comments that progress has been made in inflation measures, but that she sees inflation remaining low this year and the prospect of down readings concerns her.

"The major thing that changed since December and March that affects the baseline outlook is the slightly weaker-than-expected pace of global growth," Yellen said in response to a question after her speech.

Diane Swonk, founder of DS Economics said the Fed chair "caged the hawks" on the FOMC and she ultimately is the most important vote on the committee.

"We see her desire to really experiment and let the unemployment rate fall further. She's given herself wiggle room with the data. Obviously, data dependent means something else. It means 'subjective data dependence.' ... Glacial is now an overstatement for Fed rate hikes. We'll probably get one in June but I also think we'll get two dissents in April. This is going to be confusing for markets over this tug of war to raise rates or not."

"I don't think she meant to pull back markets as much as she did. ... I think the reaction to it is because it stands in such bold contrast to: 'Let's go, let's go, let's go,'" said Swonk

She said Yellen believes that there could be persistently low inflation even in a lower unemployment environment where employers do not increase wages, sparking inflation.

Markets also priced out a full rate hike for 2016 immediately following Yellen's comments, and according to RBS, the odds for a rate rise fell to 25 percent for June from 32 percent. The expectation for a full rate hike by December dropped to a 90 percent chance.

"One of the challenges of transparency is when you're transparent during a period where policy is in flux, and new things are being tested. In being transparent, you're also exposing vulnerability and that's what we're seeing here," said Saporta.

Read MoreShock cuts to Q1 GDP show economy could be faltering

John Briggs, head of strategy for the Americas at RBS, said Yellen was not so much countering the hawkish comments but reinforcing the March FOMC statement.

"How much of this is keeping markets on your side to gain time for overseas concerns? The Fed gets very involved in the markets so it's hard to tell," said Briggs. "Either way, her comments are conducive for easier financial conditions for the United States."

Yellen did say the U.S. economy and labor situation in particular are making progress, but her concerns suggest a very slow path of rate hikes. She also said the Fed has the ability to be accommodative. Recent data have been mixed and economists cut the median first-quarter GDP growth tracking estimate to just 0.9 percent Monday after weaker consumer spending data and a wider trade gap.

"I think it depends on all of the things she's really focusing on — inflation expectations, overseas and whether the U.S. economy holds up. Certainly what she's doing is helping weaken the dollar which helps out the overseas side, keeps rates low and stocks higher," said Briggs.