U.S. oil prices closed slightly higher on Thursday, and posted their largest monthly gain in almost a year and also a quarterly rise, helped by a weak dollar and data showing a drawdown in crude stocks at the U.S. futures delivery hub.

But concerns that a proposed production freeze will barely make a difference to the global oil glut kept a lid on the market's upside, some traders and analysts said.

Crude futures also appeared to have overextended gains with a 50-percent rally since mid-February on the prospect of an agreement among the world's largest producers to keep oil output at January's levels, despite little improvement in fundamentals.

"Oversupply still persists due to resilient U.S. production, even if declining moderately; high OPEC output, led by Saudi Arabia and Iraq; and the gradual return of Iran starting Q1 2016," said Mike Wittner, global head of oil research at Societe Generale.

Brent crude futures rose 31 cents to $39.57 a barrel. June Brent, which will be front-month from Friday, was up 1.3 percent.

On a monthly basis, Brent's front-month was on track to a 10 percent gain for March — its best since April 2015 — and a 6 percent rise in the first quarter.

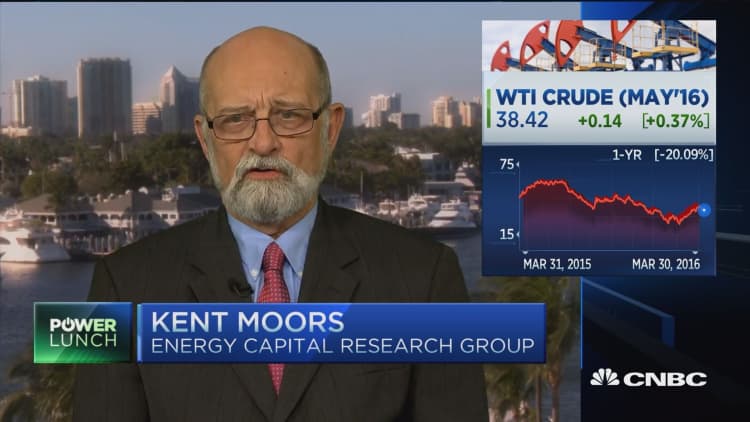

The front-month contract for U.S. crude futures closed 2 cents higher, at $38.34 a barrel, after dropping to $37.57, the lowest since March 16. It also posted a 13 percent gain in March and 3 percent for the quarter.

The dollar hit a mid-October low, making greenback-denominated oil more attractive to holders of the euro and other currencies.

Data from market intelligence firm Genscape showed a 807,496-barrel drawdown in stocks at the Cushing, Oklahoma delivery hub for U.S. crude futures in the week to March 29, traders said.

Inventories at Cushing have receded from record highs for two consecutive weeks, with U.S. government data on Wednesday showing a 272,000-barrel drawdown in the week ending March 25.

Total U.S. crude stocks, however, rose 2.3 million barrels last week to 534.8 million barrels, a record high for a seventh straight week.

OPEC crude output rose in March to 32.47 million barrels per day from 32.37 million bpd in February, a Reuters survey said.

In a separate Reuters poll, oil analysts raised their average price forecasts for 2016 for the first time in 10 months but cautioned the rally could fade near term.

Analysts also expect an April 17 meeting of major oil producers in Doha to discuss the output freeze to fall short of expectations.

"There is a clear risk of disappointment and for a temporary setback in prices ahead or immediately after the Doha meeting," Carsten Fritsch, commodities analyst at Commerzbank, told the Reuters Global Oil Forum.