Traders are hoping minutes from the Fed's last meeting will help clarify the outlook for rates, but central bank watchers are less optimistic.

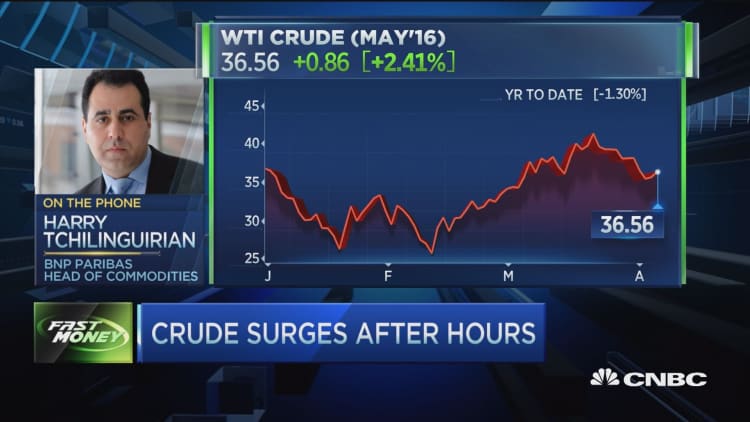

They are also keeping an eye on oil, and U.S. crude futures held above the important $35 level Tuesday. U.S. inventory data are released at 10:30 a.m. EDT Wednesday.

Fed minutes are released at 2 p.m. EDT and are from the March 15 and 16 meeting, where the central bank left rates unchanged and lowered its forecast for rate hikes this year from four to two. One member, Kansas City Fed President Esther George, dissented.

"I don't know what people want right now. People would rather have a stronger economy, banks going up and a hawkish Fed. But I don't think the data supports it and the action in Europe and (Japan's) is keeping those dove feathers intact," said Scott Redler, partner at T3Live.com.

Interest is high in the minutes, after Fed Chair Janet Yellen last week assured markets the central bank would be cautious in raising rates, stating that there are plenty of risks to its forecast. Those comments reverberated through markets, which now have low expectations for a rate hike this year, but they also follow the more hawkish words of other Fed officials who said the Fed could raise rates as early as April.

"We're kind of done with Fed speak. It's been a deluge since the meeting. ... Haven't we done all this already? I'm not sure what it could firm up for us," said Chris Rupkey, chief financial economist at MUFG Union Bank.

"We had two come out and say they could go in April, including (San Francisco Fed President John) Williams and (Atlanta Fed President Dennis) Lockhart. Then we had Yellen at the New York Economic Club saying never, or at least that's the way the market took it, and then we had (Boston Fed President Eric) Rosengren say the market is wrong to say none or one this year," said Rupkey.

The conflicting voices after the Fed gathering surprised traders since the Fed's meeting statement was very dovish. However, Yellen's words were perceived as even more dovish than the minutes.

Read MoreFed's Kashkari: Risks still lurk in banking system

"She chose to focus more on the negatives. I don't see where the minutes deviate from what she said. I think she'll focus more on the risks to the forecast than the forecast itself," said Jim Caron, fixed income portfolio manager at Morgan Stanley Investment Management.

Caron said Yellen succeeded in changing views on the Fed policy response to include international events. In her comments last week, she pointed to concerns about Chinese growth, and international developments.

"She's really worried about international events and worried about financial conditions. She's worried about the dollar," said Caron. "I think she realizes it's the feedback from a global perspective that the U.S. economy gets and the global economy in general. When the dollar's too strong, it's pretty negative."

Caron said Yellen has reverted to her old view that rates could stay low for a long time, even if it means inflation could rise. "It seems like she's gone back to her old stripes ... worry about inflation later, hike faster if you need to," he said.

The contrasting view on the Fed is that there is a risk from inflation, even though it has been running below the central bank's target. "I think the Fed minutes are going to reveal differences in views in the Fed," said Diane Swonk, founder of DS Economics. "The more hawkish concerns we have are some wage acceleration in a low-productivity environment. The hawks are worried about inflation picking up and the Fed getting behind the curve."

"We know the committee is split. I don't know how much more we could learn. How else it could come out. The big issue for me (Wednesday) is really the world economic outlook from the IMF," said Rupkey. He said the IMF should be downgrading the economy, when the report is released at 9:30 a.m. EDT.

Traders are also keeping an eye on global bond yields. The German 10-year bund yield edged toward zero, trading at 0.08 percent Tuesday. U.S. yields also moved lower in sympathy, and the 10-year was at 1.72 percent Tuesday.

Read MoreThis could be a historic moment in the Treasury market

Stocks were weak on global economic concerns Tuesday, and economists ratcheted down U.S. growth for the first quarter to 0.5 percent after the trade gap was reported as wider than expected. The fell 1 percent to 2,045.

"The S&P broke below the eight-day (moving average) which was right around 2,054 and held Friday's lows. It's not like things truly fell apart. It felt like a slow controlled pullback, versus any kind of fear yet," said Redler, who follows short-term technicals.

Redler said the market is showing a loss of momentum, and on a short-term level traders are using 2,042 on the S&P as support.

Read MoreEconomy may not have grown at all in first quarter

"We are getting a lot closer to earnings season where there are more blackouts and a lack of company buybacks. That's why we are losing some momentum up here," he said.

Redler said traders are trying to figure out whether the rally is changing. "After earnings season, will the first mini correction start? We'll start to see some preannouncements coming in. You're seeing Cree get hit after hours. Traders aren't in a rush to buy dips, and they're not in a rush to press weakness. Today if you came in and shorted the open, you wouldn't have made any money," said Redler.