Professional athletes' salaries have moved inexorably higher for decades. But they could take a hit if disputes between cable operators and regional sports keep happening.

TV deals for sporting events have grown exponentially over the past few decades, boosting major sports leagues' revenue and, to a large degree, allowing teams to pay their athletes high salaries.

Athletes and their agents know how important TV contracts are. NBA superstar LeBron James opted out of a two-year deal with the Cleveland Cavaliers last year in order to better set himself up for the 2016-2017 season, when the NBA's $2.7 billion-per-year distribution deal kicks in, raising the league's team salary cap to a projected $89 million from nearly $70 million.

But recently, the cable companies that foot the bill for those multi-million and multi-billion television deals have pushed back against sports networks, arguing that the costs are too high.

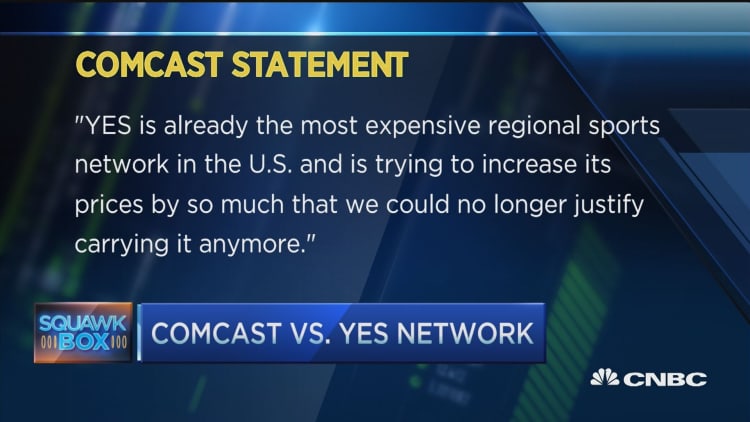

Comcast and 21st Century Fox's YES Network, which broadcasts New York Yankees baseball games, have since November been unable to reach a "carriage agreement," or the deal to air YES on Comcast cable.

Manish Tripathi, a marketing professor at Emory University in Atlanta, said salary caps in some leagues would take a hit if networks like YES are dropped by the likes of Comcast or are forced to charge less money per subscriber, though the effects wouldn't come immediately. "This would happen over time," he said. "The athletes wouldn't necessarily feel this pinch immediately."

However, Stephen Walters, a professor of economics at Loyola University in Maryland, disagreed. He said the effect "could be fairly immediate," because teams "offload big-money contracts all the time when revenue falls."

Comcast told CNBC last week that it can't justify paying YES' fees since the network's game ratings dropped 40 percent from 2010 to 2015, said John Demming, a company spokesperson, citing Nielsen statistics. He also said there were no ongoing negotiations between YES and Comcast.

The disagreement has left nearly 1 million Yankees fans across Pennsylvania, New Jersey and Connecticut, in the lurch.

"Comcast should restore YES to its lineup and honor the deal to which it agreed last season, so that YES's Yankees telecasts, among the most popular sports programming in the U.S., are available to all Comcast viewers in the Tri-State area," a YES spokesperson said in a statement Tuesday.

Such disputes are not uncommon and "typically, in these kinds of disputes, … the networks win," said Erica Gruen, principal at Quantum Media, a media consulting firm in New York City.

That said, Time Warner Cable, which holds a majority stake in SportsNet LA, the Los Angeles Dodgers' regional sports network, has been unsuccessful in convincing other carriers in the Los Angeles area to pick up the network — leaving approximately 70 percent of the market in the dark.

The real indicator in these disputes will come during next year's free agency window, Rodney Fort, a sports economics professor at the University of Michigan. "If you see the contracts going up, I think it's safe to say the [networks] think they're going to win."

The largest contract in baseball currently belongs to Miami Marlins right fielder Giancarlo Stanton, worth $325 million, followed by Yankees designated hitter Alex Rodriguez, whose deal is worth $275 million, according to sports contract website Spotrac.

A wildcard in all this? Changing technology.

Loyola's Walters said the emergence of cord-cutting options for consumers "might reduce such disputes over time. New technologies are creating new revenue streams for teams, too … and it's likely that emerging technologies will eventually enable teams to bypass the cable operators if the latter try to withhold access to their systems."

Disclosure: Comcast is the owner of NBCUniversal, the parent company of CNBC and CNBC.com.