Oil Hits 2016 High

Crude surging today, closing at the highest level in nearly five months and above its 200-day moving average for the first time since July 2014.

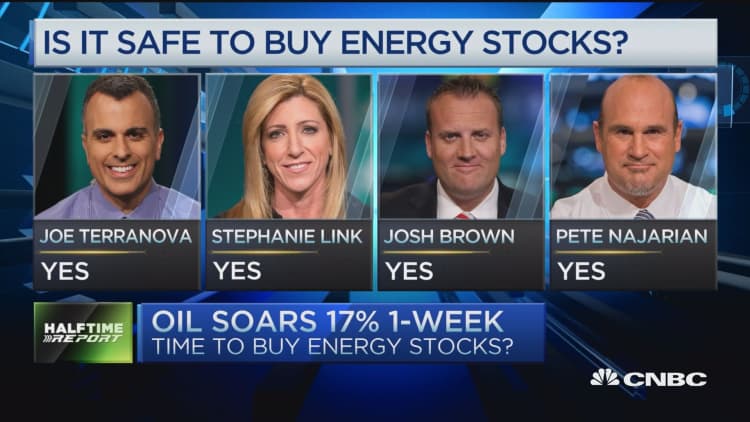

So is it finally safe to buy energy stocks? The Halftime Report experts agree it's time to go bottom fishing in the sector.

"Buy energy companies with strong management teams and good balance sheets that could weather the storm," said Stephanie Link, Active Equities Portfolio Manager at TIAA Global Asset Management, a firm with $861 billion in assets under management. "For example, Anadarko Petroleum is up 44% from its lows but it has a long way to go."

We're starting to see a supply response that will bring markets into better balance.John S. WatsonChevron CEO

"Multi-Year Opportunity" in Energy

"You have a multi-year opportunity to buy the big names like Chevron and Exxon Mobil," added Joe Terranova, Chief Market Strategist at Virtus Investment Partners. "I also like the shale survivors like Pioneer Natural Resources and EOG."

Pete Najarian says there's one name to own now. "I think oil is in this new range of $35-$45," notes Najarian. "If oil stays over $40,ConocoPhillips is the name to buy."

Finding a Bottom in Oil

"This is the anatomy of a bottom fishing trade that works," said Josh Brown, the CEO of Ritholtz Wealth Management. "Energy ETF XLE is up 30% from its 52-week low. This is a monster move. The stocks are telling you that the commodity was getting overdone to the downside."