Investors are dipping back into emerging markets, but some analysts warn the appearance of a recovery overlooks a number of potential risks in the battered asset class.

EM equity funds reversed 17 weeks of net redemptions to end the first quarter with their longest run of inflows since the third quarter of 2014, according to EPFR's Global Fund Flows and Allocations Data.

However, the inflows came solely from exchange traded funds, typically seen as short-term investments. Meanwhile, the most recent data shows those ETF inflows are moderating, at 487.1 million this past week versus 910.13 million the prior week. That has made some analysts wary.

EEM jumped more than 20 percent from lows touched in mid-January to rise 6.4 percent in the first quarter for its best quarter since 2012. The ETF is still up more than 7 percent year-to-date, while the S&P 500 is up less than 2 percent and the German DAX is off more than 6 percent. Japan's Nikkei 225 is down nearly 11.5 percent for the year so far, tracking for its first negative year since 2011.

"It's a very powerful rally but it doesn't look like investors have bought into it," said Geoff Dennis, head of global emerging markets equity strategy at UBS. "If the general positive view were to continue there's quite a lot of money that could come in."

The Brazil factor

Because U.S. stocks are on an upturn after seemingly relentless selling in the first part of the year, "you have some people believing the emerging markets should be popping as well," said J.J. Kinahan, chief strategist at TD Ameritrade.

The fund flows are "something interesting to watch for a couple of months but we need more evidence people are saying this is a very good longer-term investment opportunity," he said.

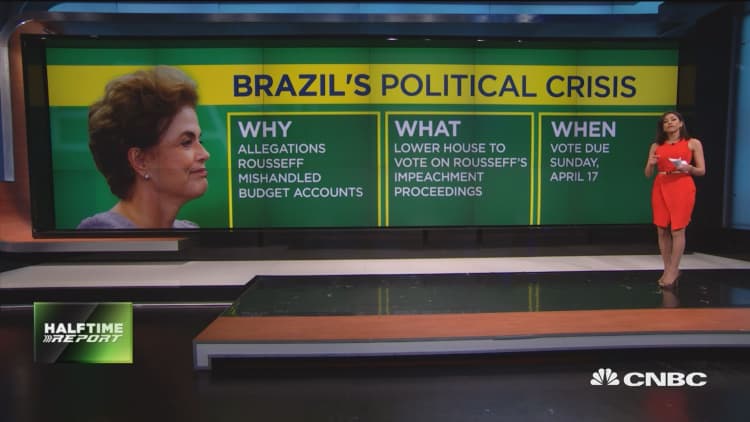

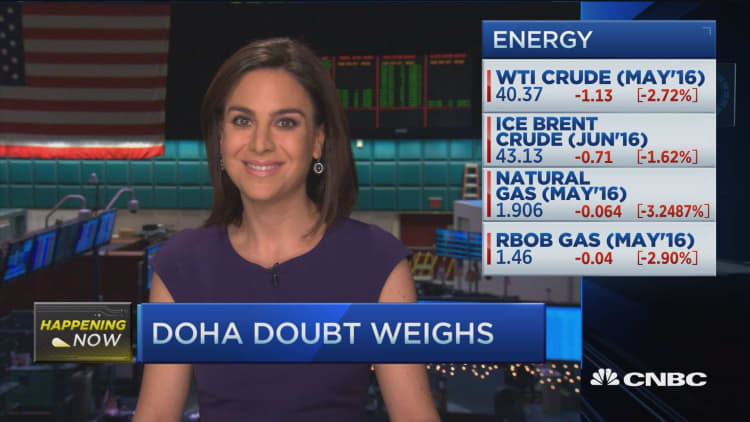

There are also two big risks to the market this Sunday. One is the Brazil lower house Congress' vote on whether to impeach President Dilma Rousseff on charges of manipulating budget accounts. The other is the meeting of oil producers in Doha, Qatar, to discuss an oil production freeze that may send crude prices surging or reeling, depending on the outcome.

Read MoreA Doha deal could boost oil prices: CNBC survey

In Brazil, Rouseff is fighting for her political life. The turn of events is a dramatic turnaround in what was once considered an emerging markets success story, and may have implications for the entire sector, analysts say.

"What happens if Rousseff doesn't get impeached?" said Peter Boockvar, chief market analyst at The Lindsey Group, noting it could be negative for Brazil and other EM names.

Emerging markets diverged in the first quarter, rising while developed markets stalled or sank. Global risk assets found support from a reversal in battered commodities a weaker dollar on expectations that Federal Reserve policy would remain accomodative. That sparked a new round of investments in EM, especially after recent underperformance — the iShares MSCI Emerging Markets ETF (EEM) fell 18 percent last year in a third-straight year of decline.

At the same time, the short emerging markets trade remains one of the two most crowded, along with long U.S. dollar, according to fund managers who responded to Bank of America Merrill Lynch's April Global Fund Manager Survey last week.

That means investors expect the dollar to strengthen against other currencies and emerging markets to fall. While the percentage expecting a decline in emerging markets fell to 19 percent in April from 26 percent in March, the persistence of negative views is striking, given the recent inflows and outperformance of the sector.

"It is not clear that the rally on a dovish Fed, weak dollar, commodity prices rebounding actually translates into a fundamental improvement in the growth story in the emerging markets," UBS's Dennis said

With the Fed still on track to raise rates, the dollar will likely strengthen again over the long term. In fact, the dollar index snapped a two-week losing streak with a half percent rise last week.

China also remains a wildcard given how its currency devaluation rattled global markets late last summer and earlier this year, amid concerns about a spillover from a sharp economic slowdown.

This past week, the International Monetary Fund lowered its projections for growth in emerging market and developing economies by 0.2 percent to 4.3 percent in 2016. However, that is still more than twice the 2.1 percent rate expected for advanced economies. If investors are willing to weather volatility, the case for investing in emerging markets can be attractive.

Emerging markets are "really a compelling investor opportunity when you consider some of the demographics," said Mike Loewengart, vice president of investment strategy at E*TRADE Capital Management. He noted that while emerging markets account for about 10 percent of global equities, the region makes up about half the global population and roughly 40 percent of the world's gross domestic product.

And while North American investments remain overwhelmingly favored by investors surveyed by E*Trade last week, for the second quarter they see more investment potential from Asia Pacific versus the European Union. Still, nearly two-thirds don't plan on adjusting their investment approach to emerging markets this quarter.

Conducted over April 1 to 10, the online study took a U.S. sample of 907 self-directed active investors who manage at least $10,000 in an online brokerage account.