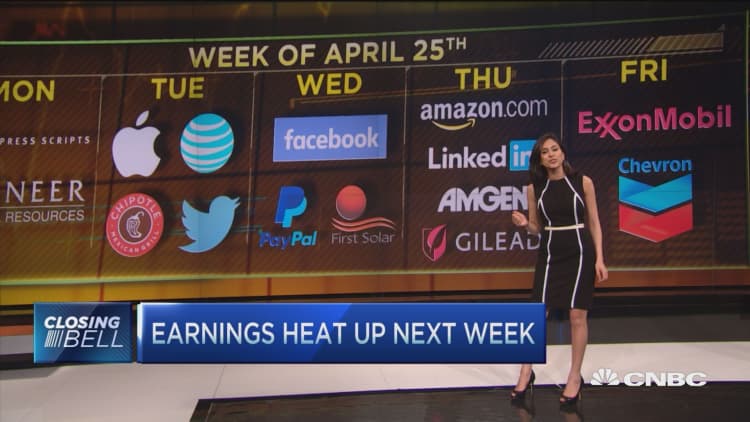

Apple, Facebook, ExxonMobil and dozens of other major companies report earnings in the week ahead, but central banks could bring on the volatility.

There is also a heavy schedule of economic reports in the coming week, including first quarter GDP on Thursday. Economists expect a barely positive number, and most forecasts are looking at growth under 1 percent. There are also durable goods Tuesday, international trade Wednesday and personal income and spending for March on Friday.

Oil inventory data from American Petroleum Institute on Tuesday afternoon and the Energy Department Wednesday morning will also be watched, as all markets are keeping an eye on oil prices. Brent was up almost 5 percent for the week to just above $45 a barrel, and the S&P energy sector was the best performer for the week — up 5 percent. The jump in oil prices surprised traders who were looking for a sell-off after producing nations failed to reach a deal to freeze production last weekend.

Stocks were higher in the past week, with the S&P 500 at 2,091.58, up 0.52 percent. The Dow was up 1.4. Stock strategists are looking for a breakout to the upside, even as yields look set to move higher.

In the coming week, the Fed meets Tuesday and Wednesday, and it is widely expected to take no action on rates, while sticking to its message that a rate hike isn't imminent.

"I think they will try their darndest to avoid any kind of policy change in their language," said Jeff Rosenberg, BlackRock's chief investment strategist for fixed income.

But then there's the Bank of Japan, which meets Thursday. "There's greater uncertainty with regard to what Japan is going to do," said Rosenberg. "I think the bigger question is whether it will have any impact." The last time the bank took action, it announced negative yields. As if in defiance, the yen ripped higher, and the negative yields ignited market fears that the program would be negative for banks.

There's speculation the BOJ could announce more asset purchases and take steps to apply negative rates to bank loans. "That is the potential risk. That would be viewed as them trying to fine tune the negative rate story so it actually helps the banking system," said George Goncalves, head of rate strategy at Nomura. He said the purchases most likely will be of more Japanese equity ETFs.

"I think it's all about what they're trying to achieve and can they do it. Even if it doesn't work long term, will it cause a market reaction? We have to be prepared for it. I think the Bank of Japan will give it a go next week, and it will be more important than the Fed," said Goncalves. "If the Fed can give a lukewarm hawkish message, and they get it right, that will keep the dollar from rallying and push long-term rates higher while pushing back hiking expectations a little more." He explained in a "lukewarm hawkish" message the Fed would appear to be intentionally holding off on rate hikes even though conditions have improved since its last meeting.

Goncalves said if the Fed is then followed by a dovish BOJ, that could push the 10-year yield closer to 2 percent. The yield on the 10-year was at 1.88 percent Friday, well above the 1.75 percent the week earlier.

Rosenberg said the markets are reversing the flight to quality trade from earlier in the year.

"I think we've had a rebound off of the beginning-of-year global concerns," said Rosenberg. "It's notable that both the Fed and the ECB (European Central Bank) cited the global concerns when describing the impacts on their policy rather than developments in their domestic economies. … It's really about relieving some of those risks."

Rosenberg said he believes the turn in the market came when oil and commodities reversed course in February. A big factor was China, when it took steps in mid-February to soothe concerns about a significant yuan devaluation. The Fed also played a role, changing its forecast from four rate hikes this year to two, and taking pressure off the dollar.

"The Fed changed its message on its pace of normalization in March. The market started to anticipate that in February, but they made good on it in March. That was important," he said. Rosenberg said the risks are still there but they've moved to the background for now. Rosenberg said China effectively calmed global fears when it emphasized policy to bring stabilization, using its traditional lever of credit growth to encourage production in real estate and infrastructure.

China was a key concern of the Fed, as it had been for the markets during the sell-off in January and February. Traders are now watching corporate earnings to see if there are any signs of change coming on that front. Caterpillar's CEO Doug Oberhelman said he believes his business is bottoming and he hopes 2016 will be the last down year.

"We've seen actually an adjustment upwards in China in the first quarter, which is kind of nice. It's the first time we've talked about that in a couple [or] three years," he told CNBC. He said China is stimulating and it is showing up in some large products. "Hopefully that will be sustained; something they do throughout the rest of the year."

But even with the stock market's gains, individual issues took a beating if they were the bearer of disappointing earnings news. High-profile misses have been seen, particularly in tech where Alphabet, IMB and Microsoft all disappointed.

But there is also a view that the worst is over for the corporate profit recession.

"This will be the fourth quarter of no earnings growth, but this is the call, truly, that this is the end of that. It may be the case where this started in the second quarter of last year, so year over year the second quarter is going to show earnings growth. That will be a very important signal," said Art Hogan, market strategist at Wunderlich Securities. "The guidance as a whole has been a lot less about pointing to the dollar and plunging oil prices."

Apple's earnings will be another test this week, since so many tech names have disappointed. But Scott Wren, senior equities strategist at Wells Fargo Investment Institute, does not expect it to make a difference to the market.

"That's not going to be anything that's going to throw off the entire earnings season, if it misses or gets a positive boost if it beats. Overall, this earnings season is like the last eight earnings seasons," Wren said. "All it does is confirm we're in a very modest growth, modest inflation environment. Clearly the market is looking way beyond the first quarter."

Wren, like others, expects the S&P to take out its 2,134 high. "We'll grind higher and test that 2,134 intraday high, but I would not think we make it through the first time or even the first couple of times. I think the market wants to go up, but we've come a long way. There's definitely a bid to the market."

Read More Here's why the disappointing earnings don't matter

What to Watch

Monday

Earnings: Halliburton, Xerox, First Data, KKR, Crane, Ethan Allen, The Container Store, Express Scripts, Canadian National Railway, Pioneer Natural Resources, Zions Bancorporation

10 a.m. New home sales

Tuesday

Federal Open Market Committee begins two-day meeting.

Earnings: Apple, 3M, DuPont, BP, AT&T, Fiat Chrysler, Procter & Gamble, Coach, Eli Lilly, Hershey, Martin Marietta Materials, Ingersoll Rand, Corning, Entergy, Whirlpool, T. Rowe Price, Lockheed Martin, JetBlue

8:30 a.m. Durable goods

9 a.m. S&P/Case-Shiller

9:45 a.m. Services PMI

10 a.m. Consumer confidence

1 p.m. $26 billion two-year note auction

Wednesday

Earnings: Facebook, Boeing, GlaxoSmithKline, United Technologies, Total, Mondelez, General Dynamics, Dr Pepper Snapple, Boston Scientific, Comcast, Baker Hughes, Anthem, Nasdaq OMX, Hess, International Paper, Southern Company, Northrop Grumman, Goodyear Tire, Marriott

8:30 a.m. International trade

10 a.m. Pending home sales

1 p.m. $34 billion five-year note auction

2 p.m. FOMC statement

Thursday

Earnings: Amazon.com, Viacom, Amgen, Gilead, ConocoPhillips, Deutsche Bank, Colgate-Palmolive, Bristol-Myers Squibb, MasterCard, Altria, Ford, Dow Chemical, Celgene, Air Products, Aetna, UPS, Eaton, Beazer Homes, Marathon Petroleum, Potash

8:30 a.m. Initial claims; real GDP Q1

10 a.m. Housing vacancies

1 p.m. $28 billion seven-year note auction

Friday

Earnings: ExxonMobil, Chevron, AstraZeneca, Eaton, VF Corp, Cabot Oil, Calpine, Moody's, American Tower, Tyco, Phillips 66

6:30 a.m. Dallas Fed President Rob Kaplan

8:30 a.m. Personal income; employment cost index

9:45 a.m. Chicago PMI

10 a.m. Consumer sentiment