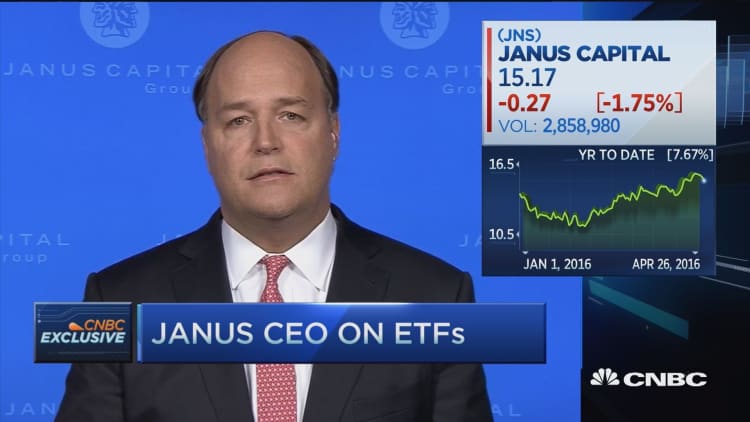

The Colorado-based Janus Capital Group reported quarterly earnings on Tuesday and while it missed analysts expectations, its CEO says the company is "on path."

"Five years ago, or a little more than that, I got here and said, 'We need to repair the firm, we need to strengthen the fundamental balance sheet, we need to strengthen the investment team by adding talent and bringing in the right people,' " Dick Weil told CNBC's "Power Lunch."

"From there we really need to focus on our clients and grow the firm."

The company reported earnings per share at 19 cents, which missed Reuters analysts expectations of 20 cents. Janus Capital also missed top-line estimates by nearly 2 percent at $249 million in comparison with revenue expectations of $253.8 million.

Weil told CNBC that a volatile market influenced first-quarter results, but the firm has seen assets under management recover along with the broader market.

"Quarterly results will vary, they vary with a lot of things: with the markets, with investment performance, with individual client idiosyncratic decisions," he said. "I don't focus so much on that in my role, what I try to do is make sure that we are on a path." The Janus stock is down two percent in the past week, but up 8 percent in the past month.

As part of his strategy to hire top talent at the firm, the former global head of Pimco Advisory brought to Janus former Pimco employee and co-founder Bill Gross, to lead its Unconstrained Bond fund.

Popularly known as the "bond king," Bill Gross is outperforming his peers at Pimco, according to Morningstar. The investment research firm reported that in the past year Gross' Janus Fund is down nearly 3 percent, while Pimco's is down 6 percent.

"His results are excellent," Weil said. "He's just the best in the business and there's no better unconstrained bond manager out there; he's beating now 83 percent of his peers on a one-year basis."

Besting other firms isn't the only thing on the Janus agenda, the firm is venturing into the ETFs market, which many analysts consider is crowded, but the CEO said it plans on differentiating itself from other companies.

"It's a very crowded market place, we are clearly not going to compete with those big firms offering chocolate and vanilla and strawberry, we need to come out with thing that are identifiably Janus, that focus on helping investors deliver value above indexes," he said.

"We are very well known for a great small and mid-cap growth investment team and we are using that for our first two ETFs."