U.S. stocks closed mixed Wednesday, amid sharp declines in Apple shares on disappointing earnings, as investors eyed the Fed statement.

The Dow Jones industrial average and S&P 500 held post-Fed gains to close slightly higher and within 2 percent of their all-time highs hit last May. (Tweet This) The Nasdaq composite closed well off lows but 7 percent below its 52-week intraday high and erasing gains for April so far. The index posted its first five-day losing streak since January 11.

Information technology closed 0.8 percent lower as the greatest decliner in the S&P as Apple fell more than 6 percent. Telecoms and energy led advancers. Facebook closed a touch higher ahead of its after-the-bell earnings report.

"It's really just earnings, earnings," said Myles Clouston, senior director at Nasdaq Advisory Services. He noted most investors did not expect the Fed to move at the conclusion of its two-day meeting Wednesday afternoon.

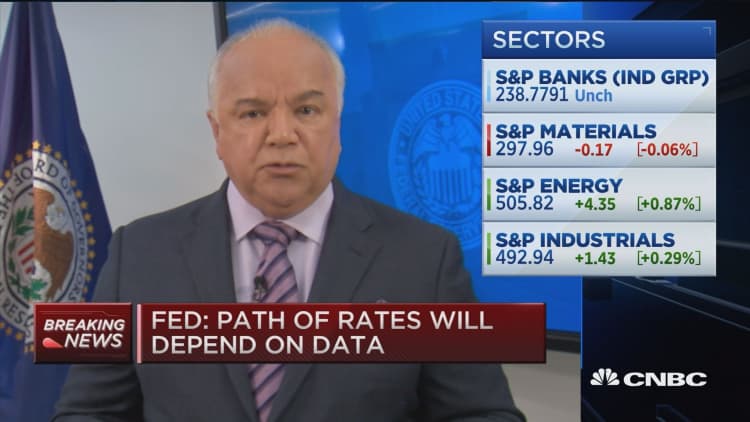

The Federal Reserve kept rates unchanged and continues to expect "only gradual increases" in the Fed funds rate.

"Nothing takes June off the table here," said Art Hogan, chief market strategist at Wunderlich Securities. "At the end of the day we want June on the table. We want economic data to be improving."

The U.S. dollar index struggled for direction in volatile trade after the Fed statement release. The euro was last near $1.13 and the yen at 111.5 yen against the greenback.

"The Fed was a non-event. The market continues to decouple on oil prices and the market is continuing to focus on fundamentals and earnings," said Kevin Mahn, president and CIO at Hennion & Walsh Asset Management.

He said the Fed maintained a "hovish" stance, meaning "they're caught in this hybrid hawkish, dovish stance."

Treasury yields held lower after briefly edging off session lows after the Fed statement release.

"I think it's going to be difficult for the Fed to hold court with their prior guidance of two hikes this year," said Brian Muench, vice president of investment management at Allianz Investment Management (AIM).

The Federal Open Market Committee's post-meeting statement said, "economic activity appears to have slowed" and that "growth in household spending has moderated, although households' real income has risen at a solid rate and consumer sentiment remains high."

The latest statement removed the line pointing to risks from global economic and financial developments.

The Bank of Japan is set to release its statement on monetary policy Thursday.

U.S. crude oil futures settled up $1.29, or 2.93 percent, at $45.33 a barrel. Earlier, WTI hit a fresh high going back to Nov. 6. WTI initially pared gains after weekly oil inventories from the EIA showed a build of about 2 million barrels.

On Tuesday, the Nasdaq composite posted its first four-day losing streak since January and information technology joined health care and financials as the only S&P 500 sectors in negative territory for the year so far.

"Probably the biggest news overhanging the market today (is) Apple's revenue miss and certainly revenue decline, ending a pretty long stretch of growth and it sort of just underscores the trouble the Nasdaq's had over the last few months," said Jack Ablin, chief investment officer at BMO Private Bank.

Apple revenues missed expectations and dropped roughly 13 percent from the same period last year, falling for the first time since 2003 as iPhone sales had their first year-over-year decline. Earnings were 10 cents short of expectations at $1.90 a share. The firm did increase its dividend by 10 percent and raised its capital return program by $50 billion.

Apple had its worst day since Jan. 27 and trade volume was more than triple average volume.

Read MoreThe Fed's dance to avoid volatility

In other earnings news, Boeing reported .

Comcast closed about 0.4 percent higher. Earlier, the stock briefly rose more than 2 percent in morning trade for the most positive impact on the Nasdaq 100. The NBCUniversal and CNBC parent posted earnings that beat on both the top and bottom line. Comcast saw growth across virtually all its business segments, and its biggest first quarter jump in TV customers in nine years.

Separately, overnight there were reports that Comcast is in talks to buy DreamWorks.

In economic news, pending home sales rose 1.4 percent in March.

Total mortgage application volume decreased 4.1 percent last week on a seasonally adjusted basis from the previous week, according to the Mortgage Bankers Association.

The U.S. advance March goods trade deficit came in at $56.90 billion, narrowing from the $62.86 gap reported in the prior month.

Major U.S. Indexes

European stocks close slightly higher, while Asian stocks closed slightly lower with the Nikkei 225 and Shanghai composite both ending almost 0.4 percent lower.

Read MoreEarly movers: CMCSA, BHI, UTX, BA, ANTM, NOC, GD, GRMN, AAPL & more

The Dow Jones industrial average closed up 51.23 points, or 0.28 percent, at 18,041.55, with Boeing leading advancers and Apple the greatest decliner.

The closed up 3.45 points, or 0.16 percent, at 2,095.15, with telecommunications leading seven sectors higher and information technology the greatest laggard.

The Nasdaq composite closed down 25.14 points, or 0.51 percent, at 4,863.14.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, held near 14.

About seven stocks advanced for every three decliners on the New York Stock Exchange, with an exchange volume of 975 million and a composite volume of nearly 4.0 billion in the close.

Gold futures for June delivery settled up $7.00 at $1,250.40 an ounce.

—CNBC's Robert Hum contributed to this report.

On tap this week:

Thursday

Earnings: AbbVie, Altria, Bristol-Myers Squibb, Celgene, Colgate-Palmolive, ConocoPhillips, Deutsche Bank, Dow Chemical, Ford, Honda Motor, MasterCard, UPS, Volkswagen, Aetna, CME Group, Domino's Pizza, Marathon Petroleum, Sirius XM Radio, Sony, Time Warner Cable, Viacom, Waste Management, Beazer Homes, Cliffs Natural Resources, Dunkin Brands, Amazon.com, Amgen, Baidu, Gilead Sciences, Samsung Electronics, Eastman Chemical, Expedia, Hartford Fincl., Juniper Networks, LinkedIn, Western Digital, Groupon, LPL Financial, Outerwall, Pandora Media

8:30 a.m. Jobless claims

8:30 .m. Real GDP Q1

10 a.m. Housing vacancies

1 p.m. $28 billion seven-year note auction

Friday

Earnings: AstraZeneca, Chevron, Exxon Mobil, Novo Nordisk, Sanofi

6:30 a.m. Dallas Fed President Rob Kaplan

8:30 a.m. Personal income; employment cost index

9:45 a.m. Chicago PMI

10 a.m. Consumer sentiment

*Planner subject to change.