The world's biggest sovereign wealth fund is launching a crackdown on executive pay, targeting high salaries at companies around the globe in an attempt to exert its influence in a debate that has been gathering pace in recent months.

Norway's $870bn oil fund, which has previously refused to interfere in how much chief executives are paid, has decided that its position is untenable and is looking for a first company to target publicly on pay in the coming months.

The move is significant for almost every listed company in the world as Norway's oil fund owns on average 1.3 per cent of each one.

The decision comes as executive pay faces increased scrutiny from shareholders, with British companies in particular facing renewed anger from investors over excessive wages.

Weir Group investors last week defeated management pay plans at the UK engineering company with a 72 per cent majority in the biggest protest against executive pay since binding UK votes were introduced.

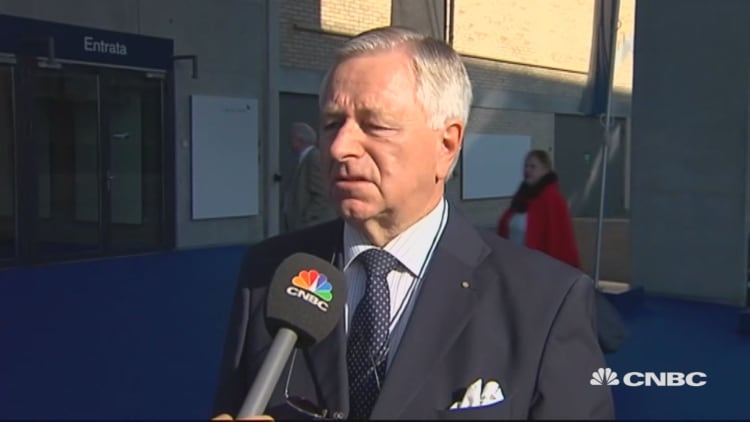

"We have so far looked at this in a way that has focused on pay structures rather than pay levels. We think, due to the way the issue of executive remuneration has developed, that we will have to look at what an appropriate level of executive remuneration is as well," Yngve Slyngstad, chief executive of the fund, told the Financial Times.

The fund has been making a big push to be more active in corporate governance matters such as election of directors and board composition. But it has previously shied away from taking a view on executive pay, due to concerns that its actions would be perceived as being influenced by Scandinavian pay conditions. Executives in the region are paid much less than in the UK or US and the gap between the highest and lowest paid in companies is far smaller.

Last month the fund voted in favour of BP chief executive Bob Dudley's pay rise, despite an overwhelming majority of other investors voting against his 20 per cent increase after it made its worst ever financial loss.

But it did vote against miner Anglo American's pay policies, as the main problem — the large number of shares executives could receive in a long-term bonus plan — was structural. It also voted against Weir.

The fund now believes that remuneration has become a global issue and is on the lookout for a sufficiently egregious example of bad pay for it to launch what it calls a position paper, laying out its principles for what it expects on a subject from its more than 9,000 shareholdings.

"We are looking at to how approach this issue in the public space. We will choose the right instance for the right case of voting," Mr Slyngstad said.

More from The Financial Times:

The simple truths of language

How fiction ruined love

Europe is moving ever closer to Britain

The oil fund until recently was highly cautious about speaking out on corporate governance matters, arguing that it was purely a financial investor. But after seeing its assets rise sevenfold in the past 11 years, it concluded that it cannot escape its responsibility as a large investor.

It has led a successful campaign to persuade many Swedish companies to allow the election of directors individually rather than as an entire team, and has been part of the big push on proxy access — the ability of shareholders to propose board members — in the US. The fund has also slowly started publishing some of its voting intentions ahead of annual meetings in perhaps its most radical step so far.