Swiss bank UBS reported earnings in line with forecasts on Tuesday, as its wealth management business attracted strong inflows, but said it saw "abnormally low" transaction volumes in the first quarter as clients became more risk averse.

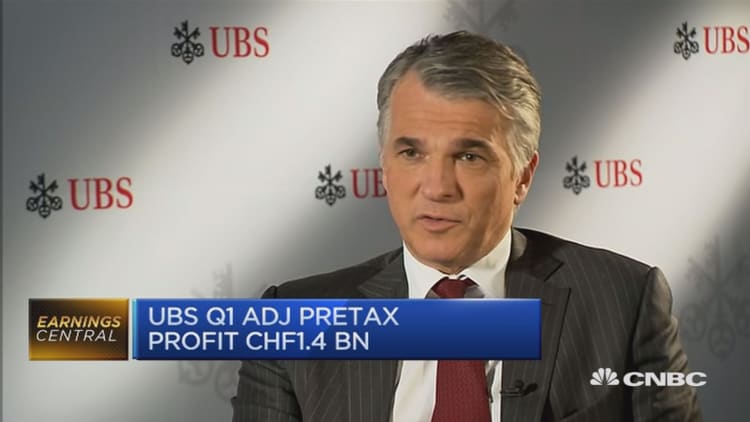

CEO Sergio Ermotti told CNBC he expected the environment to remain challenging.

"We had really, a new level of client risk-aversion in the first quarter. We observed it across the board and particularly it was reflected in transaction volumes and activity, where we saw the lowest level we could observe for many, many years and therefore, clearly, our profitability has suffered," Ermotti said on Tuesday.

First-quarter adjusted profit before tax came in at 1.4 billion Swiss francs ($1.47 billion), the bank reported on Tuesday, down from adjusted profit before tax of 2.3 billion Swiss francs in the same period in 2015.

UBS had a "Tier 1" capital ratio of 14.0 percent in the first quarter.

Ermotti said the bank had been hit by a "double whammy" of low or negative interest rates from the major central banks and regulatory requirements for banks to hold high levels of capital.

"When you would see, historically, such a contraction of transaction activity, clients would then go into cash and as a bank usually you would make some money out of your replicating portfolio, out of your deposits. In this environment of zero or negative rates you make no money, or you lose money, and in addition to that, through the new regulations, you have huge capital requirements. So it is a double whammy on the business both in terms of profitability and capital consumption," Ermotti told CNBC on Tuesday.

UBS's wealth management businesses attracted net new money of 29 billion Swiss francs between January and March, which was a quarterly record since 2008.

Plus, its personal banking division saw net new business volume growth of almost 5 percent and attracted a record level of net new domestic clients for a first quarter.

However, Ermotti told CNBC there were several factors pushing investors to keep money on the sidelines.

"There is also an accumulation of geopolitical events making people very concerned, being on the terrorism front, or being also the upcoming elections in one country or the Brexit vote in the U.K. ... There is not enough clarity for people to put their money to work in asset classes that have a higher risk profile," he said.

These challenges were unlikely to be resolved in the foreseeable future, the bank warned. It also flagged other headwinds, including low interest rates, the strength of the Swiss franc — particularly against the euro — and proposed changes to the Swiss and international regulatory frameworks for banks that will result in higher capital requirements and costs. UBS added however that it was well positioned to meet upcoming requirements for Swiss "systemically important" banks.

The bank confirmed it would pay an ordinary dividend of 0.60 Swiss francs per share, as well as a special dividend of 0.25 per share, for 2015. Its AGM will take place on May 10.

UBS is on track to make net cost reduction of 2.1 billion Swiss francs by the end of 2017.

Follow CNBC International on Twitter and Facebook.