It appears that mutual funds as a group are betting big on Fed rate hikes — whether they mean to or not.

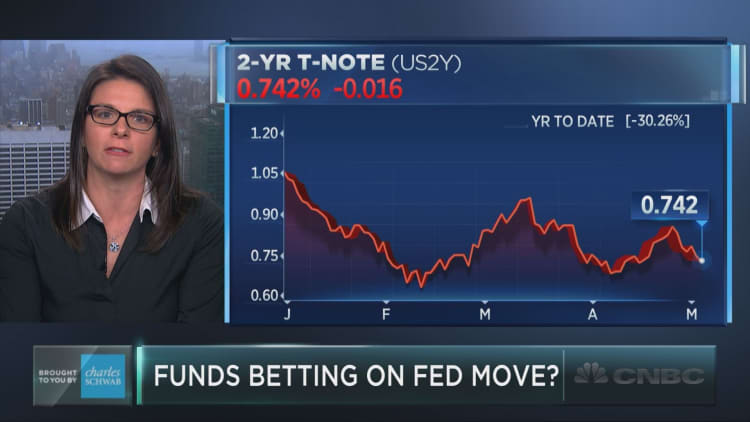

According to a report from JPMorgan's equity strategy and quantitative research group, excess mutual fund returns (that is, performance as compared to benchmarks) show a notable correlation to the 2-year Treasury yield.

Since future increases in rate targets by the Federal Reserve are the most obvious positive driver of short-term rates, the JPMorgan strategy team led by Dubravko Lakos-Bujas extrapolates that funds have an "implicit macro [view] of being long Fed expectations."

To be sure, it's not that these funds are placing short-term bets on Treasurys or on credit derivatives. Rather, funds are currently more heavily weighted in growth stocks than in value names compared with their benchmarks. Since growth companies appear more interest-rate sensitive (perhaps given their potential need for financing), a dovish Fed has consequently contributed to the poor performance of macro funds, the analysts said in the report Wednesday.

It hasn't been the only driver of underperformance, however. More generally, value stocks have beaten growth stocks this year due to a bevy of catalysts, which is one reason that only 38 percent of funds are beating their benchmarks this year — versus 49 percent at the same time last year.

After a December hike, the federal fund futures imply just a 13 percent chance of a rate increase in June, according to CME's FedWatch tool.

But according to Stacey Gilbert, head of derivative strategy at Susquehanna, "there are areas of the market where we're also seeing investors suggesting that the likelihood of the Fed raising, even in June, is higher than what the fed funds futures would suggest," such as high-yield bonds and utilities stocks.

People appear to believe that the chance of a hike is about 20 percent for the June meeting, Gilbert said Wednesday on CNBC's "Trading Nation."

Still, Eddy Elfenbein of the Crossing Wall Street blog maintained Wednesday that "the safe bet is to play the 'under' — to bet that the Fed won't increase rates," given the sustained weakness in economic growth.

If funds begin to make a more active effort to reduce exposure to short-term rates as a way to implement this thesis, it could be another tailwind for value stocks and create continued underperformance for those funds still on the wrong side of the trade.