Planning for retirement can be a very daunting task, even for people who are skilled at working with numbers. There are many unknowns that will affect how much you need to save and how long your money will last when you finally start your golden years.

Because the calculations involved in determining the amount to save are very intricate, often people turn to others who have the applicable skills to help. For a portion of the population, that expertise is obtained from a financial advisor who uses sophisticated tools to help guide us.

However, for a majority of households, that professional help may not be readily available or, for a variety of reasons, may not be used. So it seems only natural to turn to the internet for free tools that may help with retirement planning. Finding a good tool to help you prepare for such an important phase in your life is a very smart move.

But finding a good online tool to work with may not be as clear-cut as you think.

In a recent research project I completed with some of my colleagues at Texas Tech University and Utah Valley University, we examined how effective publicly available retirement-planning tools were at helping individuals and families plan for retirement.

Our analysis suggests that, in general, many of the available tools are not very accurate in suggesting what a person needs to do to prepare for retirement.

We used professional advisor software to see what a financial advisor would suggest for a hypothetical middle-aged family whose members needed to save more to meet their retirement goals. We then tested the same family in 36 different tools available on the internet, most of which are free to use.

"Keep reassessing on a regular basis ... what you need to save for retirement and make the appropriate adjustments over time to successfully meet your retirement goals."

Only 30 percent of the online tools suggested the clients needed to save more — the other 70 percent gave inaccurate advice by suggesting the family was on track for their retirement goals or gave an answer that wasn't clear on what they needed to do.

But even the 30 percent of tools that suggested more savings gave wildly different answers, so some of those may not be very useful.

Our work reiterates that consumers need to be diligent about the advice they seek — especially if it's free. And the better prepared you are when seeking the advice, the better able you will be to use the advice.

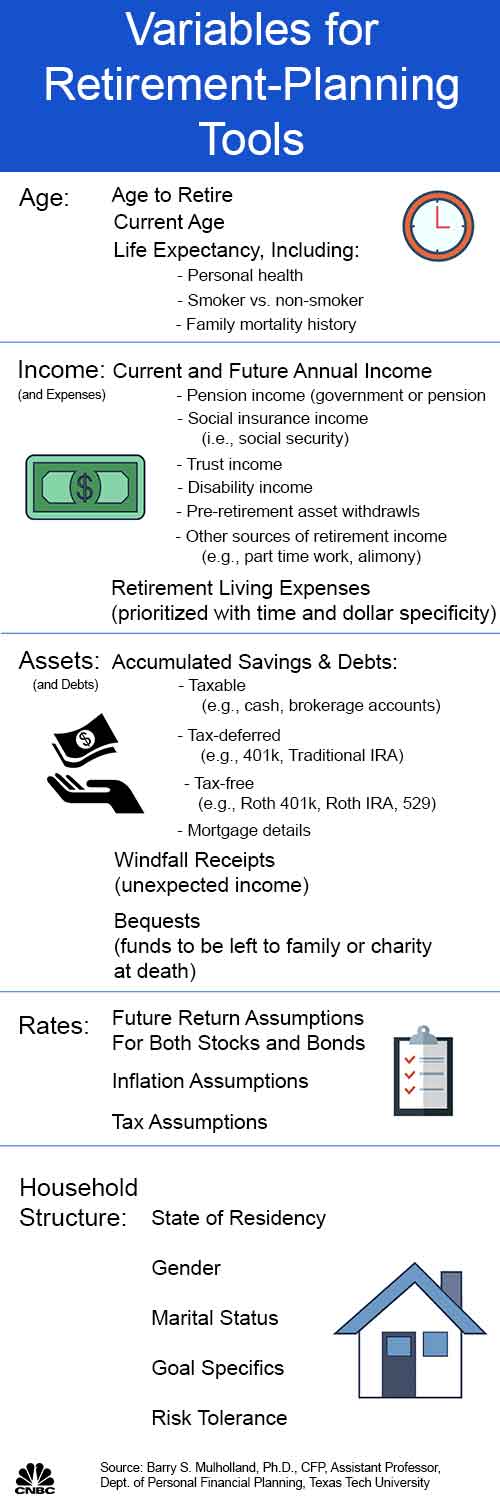

When it comes to using retirement-planning tools, we find that the inputs are critical to getting the best advice from the tool. Our research suggests that the following inputs are important to determining how much you need to save for the retirement you want to have.

The more of these variables that are included in the tool and adjustable to your circumstance, the better the resulting advice from the tool.

As you use online retirement tools, remember that the assumption you (and the tools) make about each input is critical to getting the best advice for you.

Be sure you think about the inputs, and only when you agree with the assumptions being made will you be able to trust the advice the tool provides.

Also, the input assumptions change with time, so be sure to keep reassessing on a regular basis (every year or two is best) what you need to save for retirement, and make the appropriate adjustments over time to successfully meet your retirement goals.

— By Barry S. Mulholland, Ph.D.,CFP, assistant professor, Dept. of Personal Financial Planning, Texas TechUniversity. Harold Evensky and Taft Dorman of Texas Tech University and Qianwen (Rachel) Bi of Utah Valley University contributed to this article.