Pessimism is growing among wealthier Americans, according to results from the spring 2016 CNBC Millionaire Survey.

While 35 percent of respondents said in April 2015 that they believe their kids will be "financially worse off" than they were, nearly 40 percent said the same a year later. Contrast that with 32 percent who said their kids would be "better off" in 2015, and 31 percent who said the same in the latest survey.

One anxiety trigger is about future tax rates, said Itasca, Illinois-based financial planner Kevin Meehan, whose clients include high-net-worth individuals. Local and federal budgets are being stretched to cover pensions and entitlements, putting pressure on government to raise more revenue, he said.

"Successful people are looking at these drains on society at large," he said. "Their broad expectation is that they will need to pay a lot more to cover those."

On top of that, there's the negative rhetoric from some campaigns this election cycle about business and corporate America, Meehan said.

"Success has been more demonized this year than applauded," he said.

When the survey results are broken down by political affiliation, Republican millionaires seem especially bearish about the world their children face. Last year, only 32 percent of GOP respondents said their kids would be "worse off," but this year that figure jumped to 45 percent.

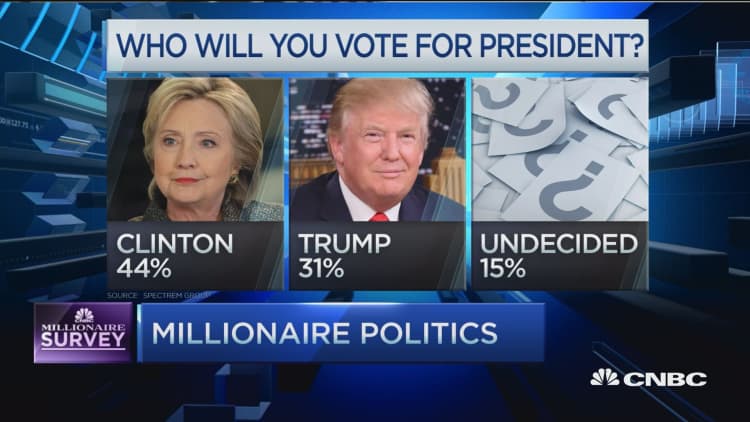

Many wealthy Republicans may fear for stocks and business growth, should a Democrat win the presidential election, said Tom Wynn, director of research for Spectrem Group, which conducts the millionaire survey for CNBC.

"A year ago, the election was much more open," he said. "Now, Clinton is the leading Democrat and potentially able to beat Trump."

But Republican millionaires may also be concerned about a Donald Trump presidency, said Wynn. Most GOP respondents to the April survey said they preferred John Kasich, who dropped out of the race last week.

There's more than just politics behind growing anxiety among wealthy individuals regarding their kids' futures, said Meehan.

"Unfortunately it's more the exception than the rule that you see money successfully inherited," he said. "If there's one consistent mistake, it's that people focus more on the assets getting passed than when their children will get those assets."

Because adult children in their 20s and 30s lack life experience, they tend not to know how to make large inheritances last, said Meehan.

One smart move? Structuring your children's inheritance so that they receive an annual income for several years or even decades before getting the rest of their money as older adults, Meehan said. That gives them more time to mature and learn budgeting, investing and savings strategies.

Another way wealthy parents can instill financial responsibility in children is to show them just how costly it can be to be rich, said Baltimore-based financial planner Lazetta Rainey Braxton, who also works with high-net-worth clients.

"A couple million doesn't necessarily get you very far these days, and kids can deplete that very quickly," she said. "So expose your kids to how much it costs to run your household, and have them help or watch while you do your taxes."

The earlier kids learn about protecting and growing wealth — and the ins and outs of tools like Roth IRAs — the less likely they will coast on the belief that their parents are "infinitely rich," Braxton said.

In general, millionaires in the survey said they are more financially resilient than their own parents: While more than 80 percent of respondents said they are "better off," only 5 percent replied that they're "worse off" than their own parents.

Spectrem surveyed 750 people in March with investable assets of at least $1 million.