Soaring costs could diminish the number of major Japanese car makers to just three or four players by 2021, according to automotive research firm Kelley Blue Book.

The world's third-largest economy is also the world's third-largest vehicle producer, boasting at least eight leading brands, including the world's biggest-selling automaker Toyota Motor. Other major car producing countries, such as Germany and the U.S., only have a handful in comparison.

But the industry, once a shining example of the country's economic heft, has had a dismal run of late. Profits at Toyota have slumped while Mitsubishi Motors has been ensnared in a fuel-economy scandal. Even suppliers haven't been spared: Airbag maker Takata reported its third net loss in the past four years on Thursday following a massive recall.

"I think we could see consolidation over the next five years down to three to four major players as opposed to so many smaller players that we have right now....You can lose a third to even half of them within the next 5-10 years," Karl Brauer, senior director of automotive industry insights at Kelley Blue Book told CNBC's Asia Squawk Box.

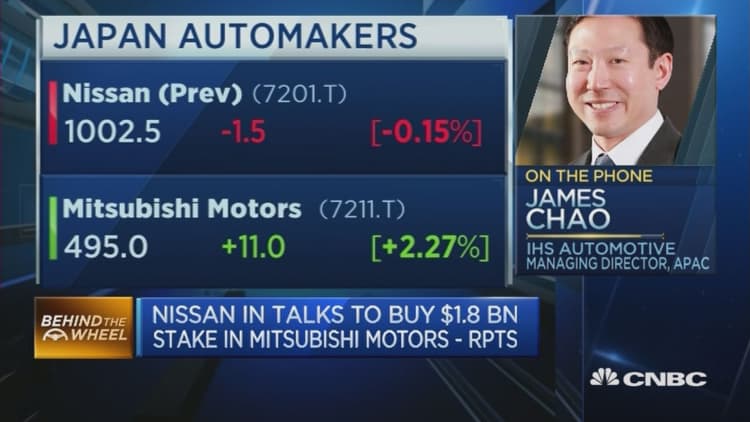

Brauer's bold call follows news out early on Thursday that Nissan Motor and Mitsubishi, two of Japan's heavyweight carmakers, confirmed they were in tie-up talks.

Nissan could pay as much as $1.85 billion for a one-third stake in Mitsubishi, making it the latter's biggest single shareholder, Reuters reported. Last month, Mitsubishi confessed that it manipulated test data to overstate the fuel efficiency of 625,000 cars, including 468,000 Nissan vehicles.

"Consolidation will be more efficient because the industry is really competitive right now and if you're not a large player, you're having trouble keeping up on the research and development spending," explained Brauer.

Moreover, costs are only set to rise in the future as the industry embraces driverless cars and vehicles that share internet access with other devices, he noted. "If you have eight companies spending that [amount of] money, it's a lot less efficient than four companies."

"This has become a business of scale. Gone are the days where you could be a 200-300,000 unit player and survive. Globalization forces are ruthlessly weeding out companies that are unable to scale up," echoed Vivek Vaidya, vice president, automotive, Frost & Sullivan.

Mitsubishi doesn't possess that ability so if not for a deal like Nissan's, the company won't be able to offer products at a competitive price, Vaidya said.

Consolidation could also be the best exit route for crisis-hit Takata.

"It's not as if the company has gone down, it's one particular component which is causing mayhem. They have so many production plans, a lot of intellectual property, so this company, at a particular price, could be a good buy," explained Vaidya.

The airbag maker announced a net loss of $120.5 million for its financial year ending in March.

Global struggles

Indeed, industry-wide consolidation in the form of mergers, acquisitions or capital alliances could make sense amid significant challenges ahead for the global industry.

"There are a lot of changes coming up—regulatory change on fuel efficacy and safety. Automakers are going to invest billions in these areas and that will impact profit percentage levels....Autos globally are becoming more vigilant on quality issues, especially as their vehicles become more complicated," said James Chao, managing director, Asia Pacific, at IHS Automotive.

Recent scandals such as Volkswagen and Mitsubishi's fuel economy manipulation as well as Takata's faulty airbags have revived the debate over greater industry oversight.

"It's my sense that the global auto industry is at their profit peak, and things are coming down," Chao noted, citing diminishing momentum from China and the fact that the U.S. market can't be expanded much more from current levels.

Toyota's recent report card seems to confirm that trend. Citing a stronger yen and tepid sales, the car giant projected a whopping 35 percent profit plunge for the fiscal year through March 2017 after reporting a 6.4 percent rise in net profit for the previous fiscal year.

However, while a 35 percent decline seems worrisome, that still amounts to $14 billion, which is still historically a high number, noted Chao.