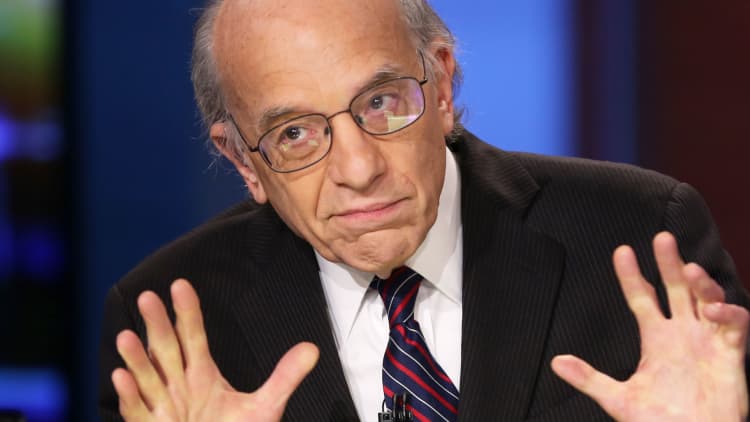

Oil has rebounded, emerging markets have come back and China hasn't collapsed — now all the market needs is earnings to move up, longtime stock bull Jeremy Siegel said Monday.

"We're going to be in this range until we see a breakout of earnings, hopefully with better retail sales … and oil stability, we will get it towards the second half of the year," the Wharton School finance professor said in an interview with CNBC's "Closing Bell."

Last year's earnings decline was all due to the collapse of the oil sector, he said.

Therefore, "the fact that oil has come back, I think convincingly, from its February lows, is very positive for the market going forward."

Oil prices hit six-month highs Monday on worries of global supply outages and as longtime bear Goldman Sachs sounded more positive on the crude market.

U.S. crude futures closed up $1.51, or 3.3 percent, at $47.72. It had touched a six-month high earlier in the day at $47.85.

settled up $1.14, or 2.4 percent, at $48.97 per barrel. It rallied to $49.47 earlier, its highest since early November.

Siegel still thinks it is "very possible" the Dow Jones industrial average will hit 19,000 by the end of the year as long as better earnings materialize.

Right now, he still thinks dividend stocks are a good play.

"I think we're really in the first or second inning of this dividend move," he said. "When we look back in history — when the S&P yields more than the 10-year, that's been an opportunity."

— Reuters contributed to this report.