Retail, technology, biotech and the financials were all taken down by the bear this week. But Jim Cramer found the one group that has quietly managed to defy any weakness in the averages, even on Tuesday when the market was hit hard.

Americans have spent fortunes to keep their pets happy and healthy. So, it makes sense that even if the economy wavers, the pet care group would continue to roar. Cramer decided to take a look at the charts to see what could be in store for Petmed Express, Blue Buffalo Pet Products, Vet Centers of America, Freshpet, Zoetis and IDEXX Laboratories.

"Sometimes the best ideas are staring you right in the face," the "Mad Money" host said.

Cramer turned to the wisdom of Bob Lang to interpret the charts. Lang is a technician and founder of ExplosiveOptions.net and a colleague of Cramer's at RealMoney.com.

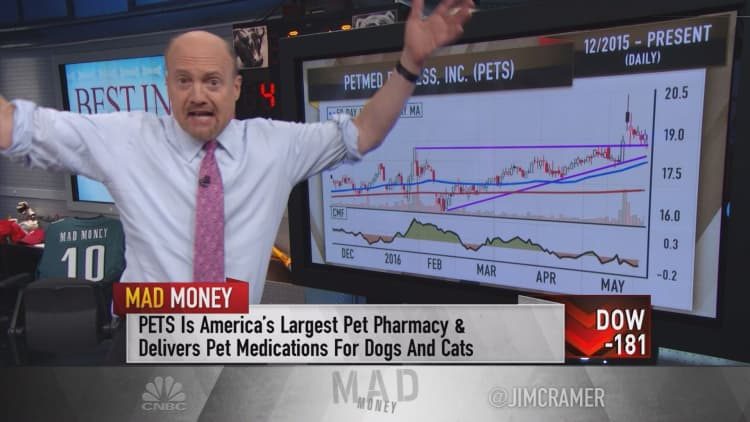

Petmed Express is America's largest pet-centric pharmacy. It recently broke out to the upside on strong volume and has been consolidating. Lang expects the stock to move sharply higher, as the volume indicated that this move is the real deal.

Buffalo Blue is the high end maker of pet food. It had the misfortune of coming public last summer before the marketwide sell-off. However, Blue Buffalo seems to have found its footing, and the stock jumped higher. Lang saw signs that big institutional money managers have been buying this stock and anticipated that it could head back to its all-time high of $29 and beyond.

Read more from Mad Money with Jim Cramer

Cramer Remix: The stock with the world's best balance sheet

Cramer's Dow Jones deep dive: The best stocks to own

Cramer: When Apple will stop being the worst loved stock in the universe

Vet Centers of America, or VCA, is the chain of animal hospitals that Lang described as a "thing of beauty." It has been rallying in a straight line since February, and he considered it a great buy on a pullback to its 20-day moving average.

Freshpet is the maker of high-end pet food that is refrigerated. It has struggled since it came public in 2014, but Cramer noted an improvement since February. The Chaikin Money flow oscillator was positive for FreshPet, along with solid volume trends and an improved chart. Lang said it could be worth buying for speculation down 50 cents from its current price.

IDEXX Laboratories is a veterinary diagnostics play. Its daily chart showed an improving range since February. The Chaikin Money flow also continued to be strong, meaning there is money flowing into the stock. Lang also noted its relative strength, and Cramer was impressed with the fundamentals.

Finally, there was Zoetis, the animal health company spun off by Pfizer. The stock exploded in March and April, and Lang said the recent pullback is simply a consolidation to digest the enormous gains.

"We learned that noted hedge fund manager Bill Ackman reduced his stake in Zoetis last week, and while the stock got hit on the news, I wouldn't read too much into it," Cramer said.

So, in a market where it is hard to find winners, pet care stocks have proven to be consistently strong. Cramer's top picks are IDEXX and Zoetis; he thinks they could work in the current environment.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com