Americans are putting less of their paychecks towards clothing purchases.

But that doesn't mean they don't love a new outfit. Instead, many seem to care less about owning it outright, which has given rise to a new subsector of retail: clothing rental and trade.

Renting clothing isn't an entirely new concept, though it's largely been geared towards formal wear, which has brought success to online players like Rent the Runway and The Black Tux.

Now, a number of companies are finding white space for renting everyday clothing and workwear.

From 2005 to 2015, spending on clothing and footwear as a percentage of total spending fell nearly half a percent, to just over three percent of consumers' spending, according to the Bureau of Economic Analysis.

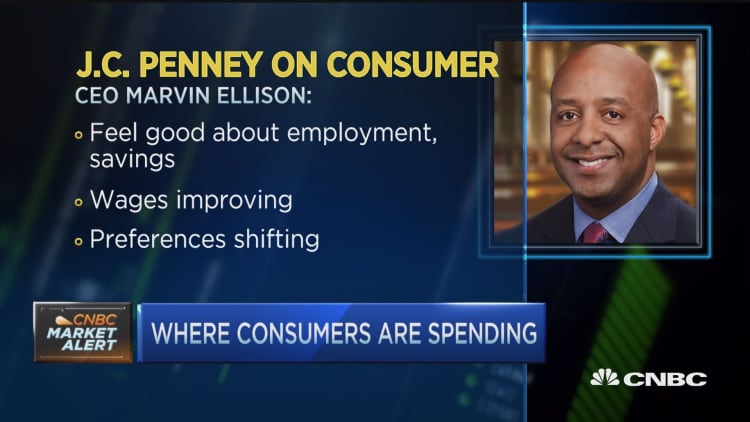

In the latest round of earnings reports, department stores felt the pinch of this shift, and blamed sluggish clothing sales for their weak performance. CEOs at Macy's, J.C. Penney, Gap and others point to changing consumer spending preferences.

Spending data does reveal less disposable income is going towards buying clothing and more is going toward restaurants, vacations, paying down debt and increasing savings.

Thrifty consumers may see clothing rental or trade in as a more budget-friendly way to build a wardrobe.

"Le Tote is like Netflix for clothing," said co-founder and CEO Rakesh Tondon. He began the subscription service to help solve the problem his wife seemingly had every day: "a closet full of clothing, with nothing to wear."

Two-year-old Le Tote shipped more than 1.5 million items to its members in 2015, and its membership is growing at a rate of 15 to 20 percent month over month. Revenue has more than doubled since last fall, the company said.

For $59 a month, members get an unlimited number of "totes" with three garments and two accessories at a time. Each tote has an average retail value of between $300 and $350. As soon as a subscriber is done with a tote, it's sent back and within several days, Le Tote sends another one. Most members receive three to four totes per month, Tondon said.

Le Tote subscribers can also keep items permanently by purchasing them at a discounted price.

Beyond rental, there are a number of online marketplaces where shoppers can trade, sell and buy second-hand clothing. These include sites such as Tradesy, ThredUp and Poshmark.

When Tradesy launched in late 2012, only 3 percent of women had ever sold clothing online, the company said. Now that number has grown to between 14 and 17 percent, as the resale market has grown since 2013 from $14 billion to $34 billion.

Venture capital hasn't missed the shift and is betting on this new subsection of retail as stock prices of traditional retailers slide to multi-year lows.

GGV Capital has a stake in Poshmark, which takes a 20 percent fee for items sold through its site that are priced at $15 or more. Although the site is currently only available in the U.S., the venture capital firm expects its business model will be easily expanded globally.

"What we like is the social interaction is powerful and they have worldwide appeal. We have inbound interest from the U.K., Australia, they just have opened up to those geographies. We think over time they can leverage their strength and interesting style," said Hans Tung, managing partner at GGV Capital.

To be sure, these rental and trade websites are in their infancy, with member and revenue growth rates typical of start-ups. The big question is whether constantly changing consumer preferences will fuel future growth and if it will continue to take a bite out of traditional retail sales.

—Sabrina Korber contributed to this report.