The possibility that the Federal Reserve could raise rates as soon as next month has pushed the dollar higher, hurting commodities and leading some to question whether gold's great 2016 run is over.

"It looks like they're serious this time about raising interest rates," said Todd Gordon of TradingAnalysis.com. "If that's the case, we're going to continue to see the dollar rally and commodities, specifically gold, sell off."

But Gordon has a bearish trade that takes advantage of the inverse relationship between the dollar and gold.

Thursday on CNBC's "Trading Nation," Gordon started with a look at the relationship between the dollar and gold, using it to establish a level for his trade. By mapping out both the gold ETF (GLD) and the dollar on short-term daily charts, Gordon marked the gold ETF's high at around $123.50 and recent low at $116.

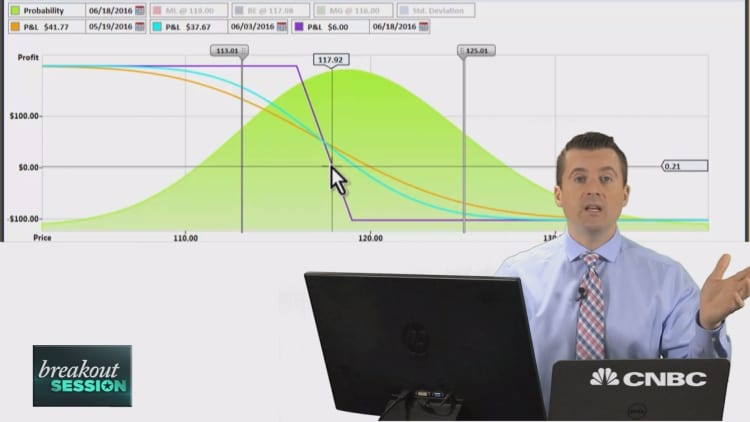

For the trade, Gordon suggests buying the June 119-strike put for $2.21 per share of the GLD, and selling the June 116-strike put for 99 cents, in a structure known as a "bear put spread."

Since he is paying $1.22 per share for the trade (or $122 per contract). Gordon's trade breaks even at $117.88. Meanwhile, maximum profits come at $116, where Gordon will make $1.88 per contract.

Notably, this contract expires two days after the Fed's June policy announcement, and therefore could be well-positioned to benefit from the Fed's next move.

Correction: This story was revised to correct that Gordon made his comments Thursday.