European stocks finished mostly lower on Monday as investors digested a fall in oil prices, mixed data out of the euro zone and the prospect of a U.S. rate hike in June.

The pan-European STOXX 600 ended trade down 0.4 percent provisionally, with industry sectors closing mostly lower.

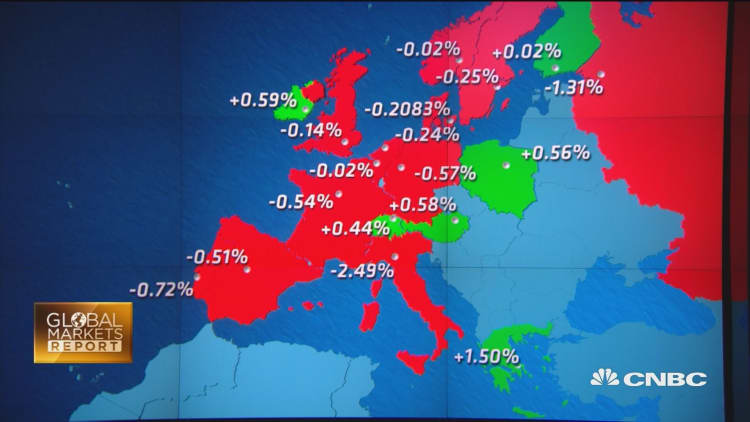

London's FTSE 100 fell around 0.3 percent, while France's CAC and Germany's DAX both closed roughly 0.7 percent lower respectively.

Athens' stock market outperformed other bourses, jumping 1.5 percent, after lawmakers approved a new privatization fund and tax increases on Sunday.

European markets

New data for the euro zone added pressure to markets on Monday, after Markit's latest flash purchasing manager's index (PMI) showed business growth in the region had hit a 16-month low in May. It came in at 52.9, down from April's 53.0.

However, Germany's PMI rose to 54.7 in May from April's 53.6; France's hit a seven-month high of 51.1.

One key point of interest was German chemicals group Bayer, who offered to acquire Monsanto for $122 per share in cash, valuing the U.S. firm at $62 billion.

Speaking to CNBC, Bayer's CEO Werner Baumann said he didn't see any major regulatory or other risks from the proposed transaction, describing the companies as "highly complementary."

Shares of Bayer, however, reacted negatively, closing down 5.7 percent.

Elsewhere in the chemicals space, OCI was Europe's worst performer, closing almost 10 percent down, after the fertilizer producer and CF Industries terminated their planned merger deal.

Oil prices fell on Monday, after Iran's deputy oil minister said the nation had no plan to freeze crude output or exports, renewing concerns of a supply glut, Reuters reported.

Both Brent and U.S. crude pared some losses throughout trade, hovering at $48.14 and $48.02 respectively, at Europe's stock market close.

Basic resource stocks slipped amid a weakening of metal prices thanks to a stronger dollar. The greenback has strengthened recently amid talk that a U.S. interest rate rise could occur in June.

Mining stocks closed mixed to lower, with BHP Billiton and ArcelorMittal posting solid losses.

Ryanair takes flight; Fiat shares slip

Elsewhere in stock news, budget airline Ryanair popped 2.2 percent after the firm announced a 43 percent rise in net profit in the 12 months to the end of March and announced it would cut fares in its next fiscal year. Fellow airline firms easyJet and Air France-KLM closed sharply higher too.

Sports Direct shares slipped 4 percent after Goldman Sachs downgraded the stock from "buy" to "neutral".

In the auto space, Fiat Chrysler ended 4.4 percent down after Bild am Sonntag reported German authorities hadaccused the carmaker of using software to cheat on emissions tests. A Fiat Chrysler spokesperson declined to comment on the report, according to Reuters. Overall as a sector, autos closed 1.3 percent down.

Asian stocks markets finished mixed on Monday, with Japanese shares under pressure on the back of a and data which showed exports were down 10.1 percent on-year in April.

Meanwhile, U.S. markets tried for gains, with material stocks boosting markets.