A slow economy, weak stock market and growing signs of deflation hardly add up to ideal conditions to raise interest rates in economist David Rosenberg's book.

As the market gears up for a potential summer tightening from the Federal Open Market Committee, with July the most likely target, the Gluskin Sheff strategist said that would be "a reckless and unnecessary move."

"Unlike other periods of tightening, there is no boom, no evident inflationary pressures or perceived bubbles to respond to," he wrote in his daily note to clients. "Maybe the FOMC is bored. Who knows?"

Market-based expectations put the chance of a Fed rate hike at 34 percent in June and 64 percent in July, numbers that rose Tuesday amid a stock market rally in which major averages posted gains of more than 1 percent.

However, those probabilities have proven volatile based on the prevailing conditions of the day as well as public statements from Fed officials. Rosenberg maintained that the prospect of a Fed move anytime soon is remote.

"The Fed has been so wrong on its forecasts for so long. They have proven their bark is far worse than their bite," he said. "None of this jawboning can be taken very seriously."

Rosenberg points to a handful of data points to make the case for no hike:

- Unemployment, currently at 5 percent in the Labor Department's headline number, would be closer to 7.5 percent when accounting for an employment-to-population ratio of 59.7 percent. (A more encompassing count that includes discouraged workers and the underemployed stands at 9.7 percent.)

- Underlying gross domestic product growth is just 1.5 percent, still significantly below trend.

- Wage growth is "still running between a half point and one-and-a-half points below the trend that (Fed Chair) Janet Yellen has said herself is consistent with sustainable 2 percent inflation."

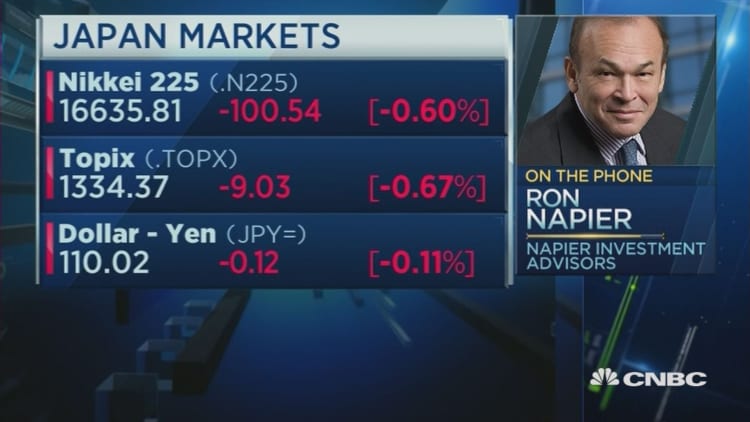

Finally, Rosenberg pointed to global slowness, particularly in Europe and Japan, and the move by multiple global central banks to loosen policy as the Fed seeks to tighten.

"The European Central Bank and Bank of Japan are openly contemplating 'Helicopter Money' to deal with their excessive leverage hurdles — why the Fed isn't focused on the same, or at least on ways to reflate rather than lean against inflation as a tool to address the debt burden is a mystery," he wrote. "Inflation does create winners and losers, but is a whole heck of a lot more effective way to cause debts to erode than outright defaults and haircuts."

Rosenberg's change in tact is interesting in that for years — both at Gluskin Sheff and, before that, at Merrill Lynch — he was known as one of Wall Street's most notable and relentless bears. Several years ago, though, he flipped his view, moving to the position that the recovery was in full throttle and that inflation, rather than deflation, was back in play.

But with a flattening yield curve the likes of which hasn't been seen since just prior to the Great Recession, coupled with the other cited factors, his thinking has changed and made him apprehensive about a Fed move in the present climate.

"The folks at the Fed claim that financial conditions have eased recently and that provides a green light for the summertime rate hike," he said. "But the only reason financial conditions have eased since February is because the Fed managed to assuage those concerns by hinting that it didn't have its finger on the proverbial button."