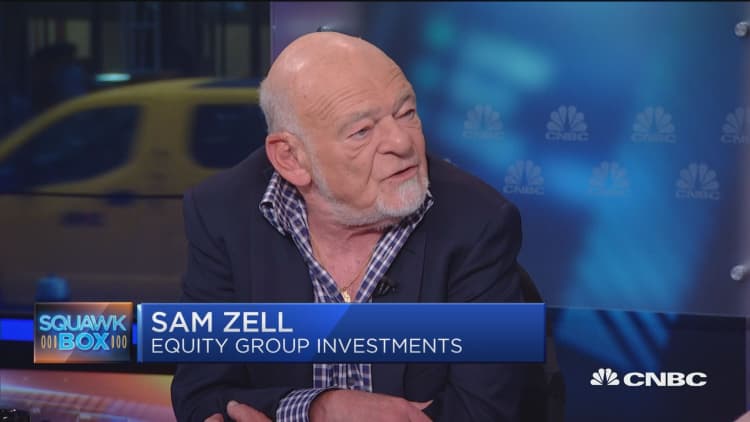

Real estate titan Sam Zell on Tuesday said his private investment firm is continuing to scoop up distressed energy assets even as it invests less in the broader market.

"We've been investing in the oil patch and buying natural gas and some other energy-related assets. Why? Because we think they're very cheap, and in many respects, they're purchasable at huge discounts to any kind of replacement costs or future competition," the chairman of Equity Group Investments told CNBC's "Squawk Box."

Crude prices are down about 55 percent from their 2014 high. The price rout, stoked by a global oil glut, has pushed nearly 80 North American companies into bankruptcy and put the entire U.S. oil patch under pressure.

Equity Group Investments is investing less today because it sees fewer opportunities and selling more because it doesn't understand buyers' optimism, Zell said. Some investors are using the principle of relative comparison to justify virtually any asset price on the market, he said.

"Well, the fact that a whole bunch of idiots have priced it on the market has very little impact on what I'm going to decide to do," he said.

Zell suggested equity valuations are reflecting a better world than the one that actually exists. He pointed to the falling value of global trade.

The value of goods that crossed borders in 2015 dropped nearly 14 percent from the previous year, according to the World Trade Monitor from the Netherlands Bureau for Economic Policy Analysis.

Zell said he is also concerned that years of low U.S. interest rates have desensitized the business community to the cost of capital and distorted markets.

"In the most simplistic terminology, I would ask you the question, if something is free, is it valued? Is it appropriately risked?" he said.

"We know that the cost of capital ain't free. Every time you defer facing up to the cost of capital, it's going to catch up to you. That I think is the biggest concern," he said.