OPEC ministers leave Vienna without a production agreement, but with plenty of talk about unity, something that could fade fast if oil prices crumble again.

Unlike the fractious meeting of OPEC members and nonmembers in Doha, Qatar, in April, and at the cartel's gathering in late 2015, officials left the meeting Thursday stressing cooperation. Energy ministers from the two biggest sources of conflict, Saudi Arabia and Iran emerged from the meeting speaking of "collaboration" and "unity."

"Pressure to act (is) seemingly off at $50. Because we did not have the public displays of discontent like in December, they can spin the nonagreement on a production ceiling as a sign of OPEC unity. The party line is that they all agreed the market is moving in the right direction," wrote Helima Croft, global head of commodity strategy at RBC Capital Markets, from Vienna.

The Organization of the Petroleum Exporting Countries did name Mohammed Barkindo of Nigeria as its new secretary-general. But it was unable to reach an agreement to set a ceiling for its production. Ahead of the meeting, analysts had expected no action from the gathering, but talk surfaced from Vienna this week that members would consider reviving the group's collective output quota.

Read MoreOPEC agrees to no change in production

"I thought it was a Saudi ruse to look nice," said Edward Morse, global head of commodities research at Citigroup. "It's not only clear that Iran was never going to accept it, but the Kuwaitis were never going to accept it. It was just a show to say we're nice people." He said that Saudi Arabia at the same time is talking about adding spare capacity and that it will add more production if necessary.

"I thought it was a show. They're like a family that doesn't want to air their dirty laundry," said John Kilduff of Again Capital. "What they're truly benefiting from is the dramatic cut from the United States in output. We're down 850,000 barrels as of today's report, from last year."

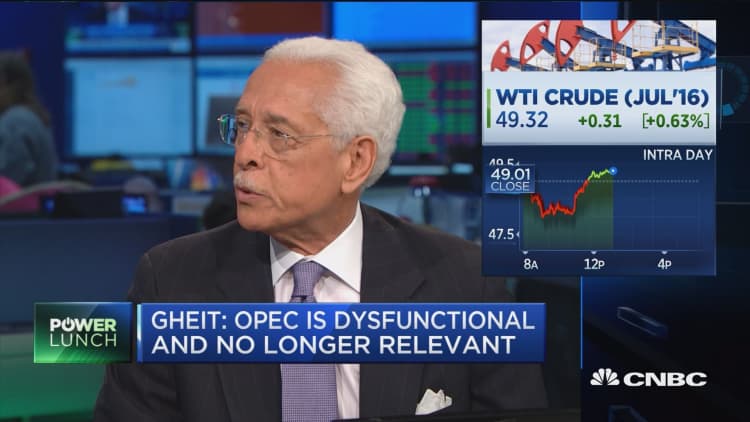

Oil futures dipped when it became clear there was no production ceiling accord, but data showing a drawdown in U.S. supply helped lift prices.

"I think if oil drops this conflict will surface again. I think the dispute between the Saudis and Iran rages on," Kilduff said.

West Texas Intermediate futures were trading lower at just above $49 per barrel in early trading Friday. On Thursday, oil sold off on the OPEC headlines but got a lift later from U.S. supply data.

"My upshot is the market had the appropriate response (to OPEC). It was a bearish response," Morse said. "They didn't have a freeze. They didn't commit to anything. They had a disagreement which means they papered it over to say something constructive is happening. The reality is nothing is happening."

Production disruptions in Nigeria, Canada and Libya, among other places, as well as reduced drilling in the U.S. have all helped lift prices to the $50 level.

"In a market where we have this amount of disruption, the need for an all-out battle or war over a limited amount of consumers is kind of put to the back burner. You're missing 3 to 4 million barrels a day of supply. The market share battle is really over who gets to supply to those customers first," said Michael Cohen, head of energy commodities research at Barclays.

Saudi Arabia's new energy minister, Khalid al-Falih, commented to CNBC after the meeting and said OPEC countries are committed to working together to steward the market.

"We are extremely happy. I think the market is in good shape. The market is balancing. Trends are all good in terms of supply and demand. Prices have recovered somewhat, and I believe they will continue to recover. The spirit of the meeting is very cooperative, collaborative, and all of the ministers see basically the same fundamentals, and we have finally selected a secretary-general, which is good, and is very highly respected and qualified," said Falih.

Iranian Oil Minister Bijan Zanganeh was similarly upbeat. "We had a very good meeting today. I believe that in this time it was a very good ... unity between OPEC members," he said. "And I didn't receive any resistance between OPEC member countries to do something against each other or to destabilize the market."

But it may not stay so congenial if prices drop again.

"No hard choices are required if the outlook is sunny," said Cohen. He does not expect oil prices to continue rising, but sees some volatile selling before prices stay steadily above $50 and move toward $60.

"They're certainly in a happier mood when prices are approaching $50 than when they are approaching $30, and that's where we were in December, at $30. Forty dollars in Doha and at $50 things don't look so bad," he said. "Given our view on prices, that is a bit of wishful thinking because this market is going to be quite volatile on the upside and downside, and we're really not out of the woods yet."

Analysts expect some weakness in the third quarter after peak U.S. driving season, and as oil returns to the market from disrupted areas.

Daniel Yergin, vice chairman of IHS, said Falih's message on prices is important, just as the comments from his predecessor Ali al-Naimi had been.

"He has a deep understanding of the markets and has a very large responsibility in Saudi Arabia, and I think his view on the market is very well-informed. He really has a global perspective on the market," he said. "His is one the most important voices on oil in the entire world and this is the first time the world has heard him speak in this new role."

Yergin said OPEC is working to heal the views that it has been torn apart by conflicts among its members. Saudi Arabia, the biggest OPEC producer, pushed a strategy to let the market set pricing in late 2014, and has been unwilling to agree to any decrease or freeze in output unless all members agree.

At the same time, Iran has steadfastly refused to alter its plans to add more oil to the market. It has been actively restoring the crude it was prohibited to sell while under sanctions for its nuclear program. Now that the sanctions have been lifted, Iran has added upward of 1.5 million barrels a day to the market, and is now producing about 3.6 million barrels a day.

"I think after Doha and after all of the conflict, I think one of the intentions was to restore credibility in OPEC as the association of these exporting countries, and I think the moderate tone indicates that was one of the objectives ... they succeeded in appointing a new secretary-general since they haven't been able to do it for years," said Yergin. "It's a sign they want to keep the association going. It's not a cartel. They are very careful not to manage production. I think one outcome is it reinforces the fact that control of the market has been handed to the market itself."

More than a third of a recent CNBC oil survey's 22 participants said they believe the crude market is currently rebalancing, though 18 percent expect it in the third quarter and 23 percent see the rebalancing in the fourth quarter. Eighteen percent expect the rebalancing in 2017, and they were evenly split between the first and second quarter.

The survey found that most U.S. shale drilling is expected to return when oil rises to $60 or above. Forty percent expected most production to return when prices reach $50 to $60, but 45 percent said it would take a price above $60 for most drilling to resume.

The latest U.S. government data on Thursday showed that the nation's oil production was at 8.7 million barrels last week, down from 9.6 million barrels in the same week last year.