Visa shares are hovering near all-time highs, and one trader who relies heavily on the charts says they could climb even more.

Todd Gordon of TradingAnalysis.com has kept an eye on Visa and other financial services companies, and he thinks that Visa can "close the gap" on a dip that happened in late April. The stock has sat at around the same level for most of May, though it began making moves upward near the end.

"Both Visa and MasterCard have performed extremely well, and I think Visa has the opportunity to move up and close a gap that was formed at about the $81 region," he said Thursday on CNBC's "Trading Nation."

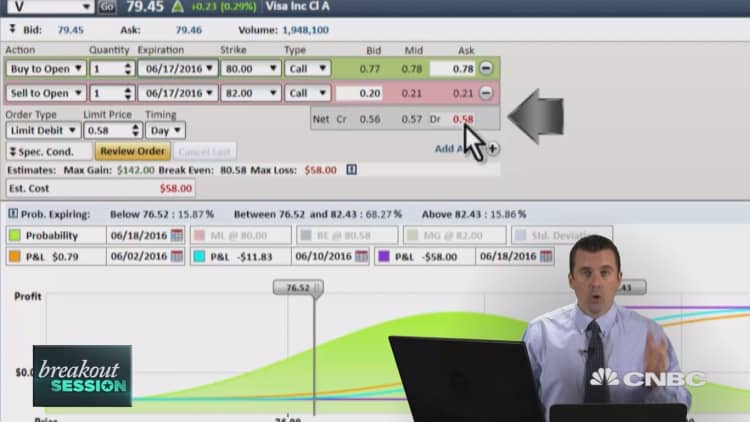

To make a play for new highs, Gordon turned to the options market. Specifically, he bought the 80/82 June call spread for 58 cents. That's the most he can lose on the trade. But if Visa can rise to $83, Gordon's trade will triple in value.

"The max profit comes in at our short strike, which is 82, which will give us a max profit of $142," he said. "So you're putting down $58 to make $142."