It's one thing for a stock to have a good dividend, and another to know that it's going to be around in a year.

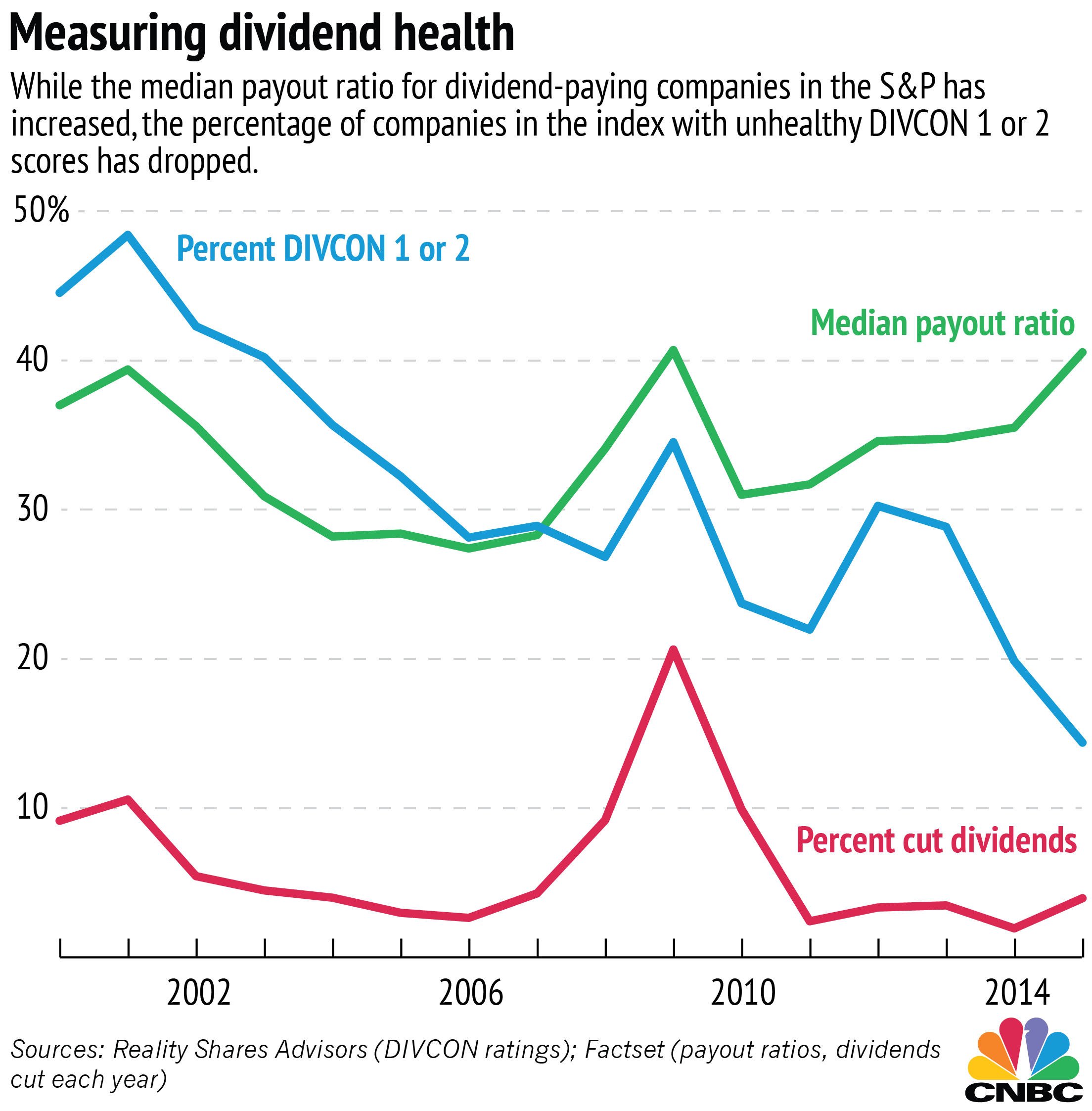

Commonly used metrics like the dividend payout ratio — the percentage of earnings paid as dividends — aren't very good at identifying whether individual dividends will disappear. But they can help investors pick out a handful of companies that will almost certainly not cut their dividends, according to a CNBC analysis.

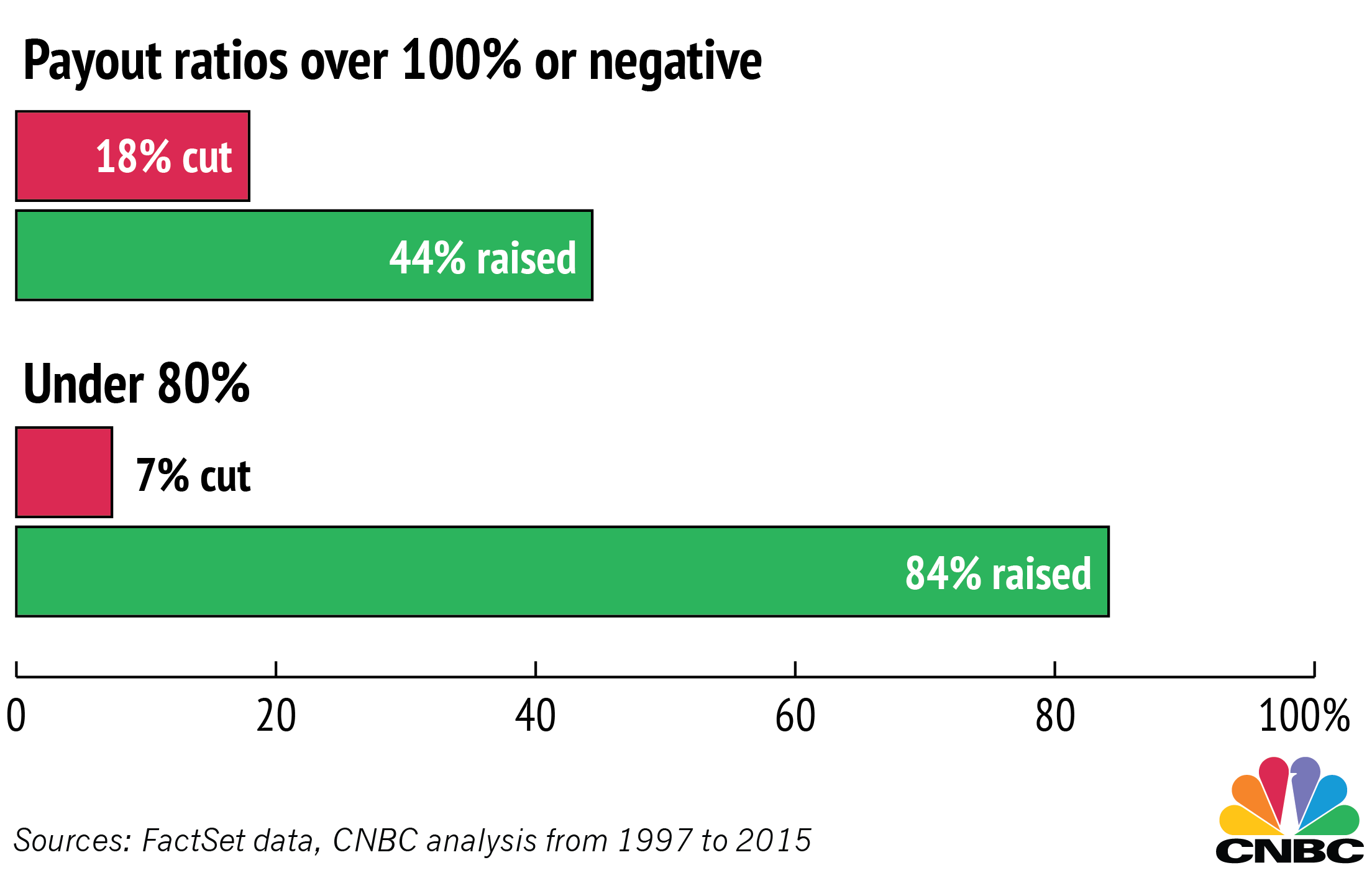

One in five companies in the S&P 500 have unhealthy payout ratios above 100 percent, but fewer than 20 percent will end up cutting their dividends in a given year or the next year. More of those at-risk companies will actually raise their dividends.

On the other hand, companies with healthy payout ratios are much less likely to cut dividends and usually raise them, which was true even during the last recession. That means companies with healthier ratios probably will continue paying during a worst-case market scenario.