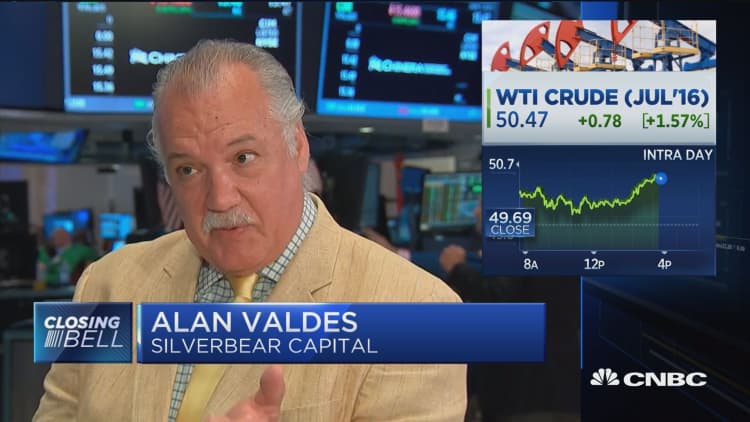

Rising oil prices are helping lead the market higher, and the good news should grow for investors over the next couple of months, trader Alan Valdes said Tuesday.

"I think you'll see this rally continue into the summer," the senior partner at Silverbear Capital said in an interview with CNBC's "Closing Bell."

His advice is to stay the course, but watch the market closely. That's because other than oil prices, the market is up on bad news like last week's disappointing jobs number, which could impact the timing of a Federal Reserve rate hike, said Valdes.

Stocks closed mixed Tuesday after rallying earlier in the day, with the closing at its highest since July 22. The Dow Jones industrial average briefly topped 18,000 in intraday trading before closing up .10 percent at 17,938.28 and the Nasdaq ended slightly down.

U.S. oil settled above $50 for the first time since July.

Trader Jonathan Corpina with Meridian Equity Partners believes Tuesday's action was just another example of the market drifting higher on light volume. He told "Closing Bell" there is no real catalyst to get in or out of equities right now.

"At this point, investors are still in this wait-and-see mode. Clearly what comes out of Washington, what's going to happen with FMOC next week and next month is really going to dictate how the third quarter is going to play out."

The Federal Reserve could raise interest rates as early as its meeting June 14–15.

For David Marcus, portfolio manager for Evermore Global Advisors, the place to be is Europe because it is just coming out of its financial crisis.

The key is to wait for bad headlines to make a move.

"You always get opportunities when people kind of go into that panicky, they're-not-sure-what-to-do mode," Marcus told "Closing Bell."

Right now, concern over Britain's vote on whether to exit the euro has provided that opportunity.

He specifically likes Vivendi, which owns Universal Music Group, and shipping company Scorpio Bulkers.

Ann Miletti, senior portfolio manager at Wells Fargo Funds, is looking for companies "that can grow regardless of the macro environment we're in, because there is really nowhere else to get a return."

One of those is transportation company Ryder Systems, she said, because there is a secular trend toward businesses outsourcing their transportation.

She also likes bank stocks. PNC and PacWest Bancorp each have a 10 percent upside in the next 12 months, Miletti predicted.

Disclosure: Marcus owns Vivendi and Scorpio Bulkers through his firm's Global Value Fund. Miletti owns PACW, PNC and R through firm funds.