Foreign investors have jumped on any opportunity this year to buy American companies.

They have spent $223 billion buying American companies, which amounts to 34 percent of the total deal value — and nearly twice the level at this time last year. That's according to a May 2016 report by Richard Peterson of S&P Global Market Intelligence. Total U.S. mergers and acquisitions spending in 2016 is $663 billion, including a proposed acquisition of LinkedIn by Microsoft for $26.2 billion announced Monday.

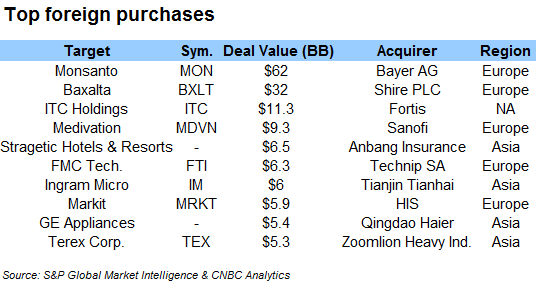

This year's 34 percent share of foreign acquirers is by far the highest in all the data going back to 1998: