With palpable fear in the market that Britain could vote to leave the European Union next week, this whole situation is starting to feel a little Greek to Jim Cramer.

"Even if that unknown event happens, it won't lead to the chaos that many seem to be expecting," the "Mad Money" host said.

The last time Cramer went through a possible Europe break-up was when Greece, Ireland, Spain, Portugal and Italy were threatening to default on their debt in 2011. That situation would have been felt all over the world, though the European central bank was ready for the worst.

"If the U.K. leaves the European Union, it will be dealt with. Whatever happens, it likely won't drag out the way Greece did," Cramer said.

He expects the pajama traders to come out of the woodwork, of course, which means hedge funds will trade in lockstep with Europe. However, even if the U.K. voted to leave, it won't break-up the euro. This isn't as bad as the European debt crisis.

I think this thing has gotten overblown beyond proportions.Jim Cramer

"It is a decision by one country to be less formally enthralled with a bunch of others, and it will really impact a handful of the 317 million people who live in America," Cramer said.

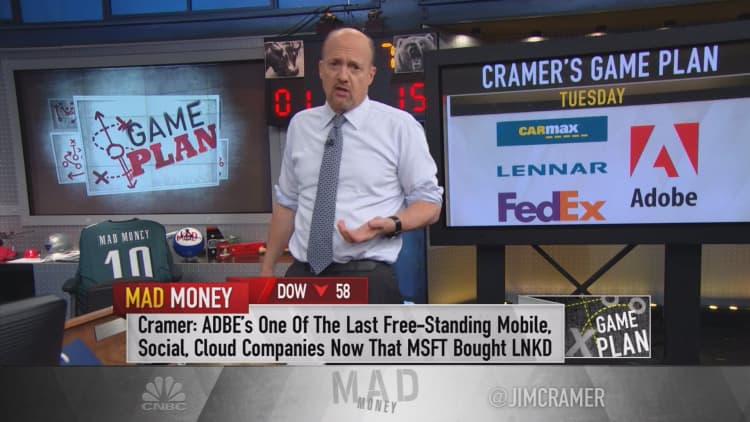

Both ways, Cramer will be ready and waiting when anything happens. He shared his game plan of stocks and events he will be watching next week:

Tuesday: Carmax, Lennar, Adobe, FedEx

Carmax: Cramer is looking to hear about the state of auto loans. Are they a ti

Adobe: Cramer is willing to bet it will blow away the numbers. He knows technology is out of favor right now, but with the consolidation happening in this group — courtesy of Microsoft's recent acquisition of LinkedIn — he's willing to bet it will be a strong quarter.

Wednesday: Janet Yellen speaks, oil inventories, Bed Bath & Beyond, Red Hat

Oil: Inventories will be reported just 30 minutes after Yellen starts to speak, so oil will have a tight range. If the inventories are low, Cramer thinks oil will go to $50 a barrel. If inventories are high, prices will fall to $45.

Thursday: Accenture

Accenture: This consulting company is doing so well, Cramer thinks it makes sense to buy some before the earnings report and then more after if the U.K. votes to leave the EU.

Friday: Brexit vote

"I think this thing has gotten overblown beyond proportions, but if you prepare for disaster with your list of unaffected buys — as opposed to affected sells — then you will be ready for anything that the Brits throw at you," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com