When Jim Cramer showed up at the New York Stock Exchange on Friday morning and saw a line of media trucks sitting out front, he knew the market would be in panic. Historically, he only sees news trucks appear when there is a panic, typically after the bottom of a big decline the day before.

"They were all set to cover the bloodbath," the "Mad Money" host said.

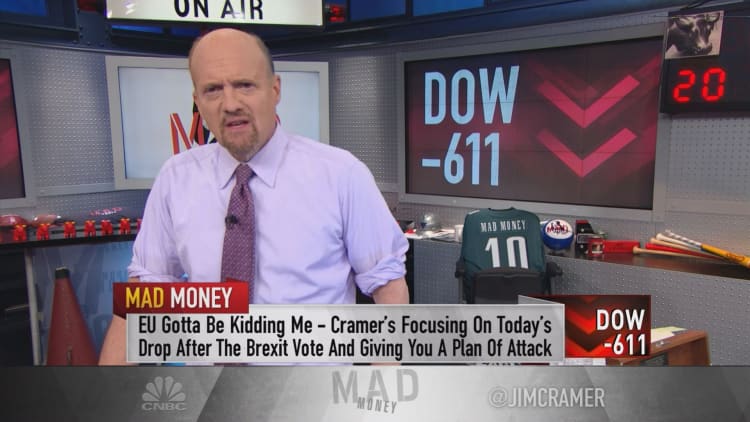

By the end of the day, the Dow Jones industrial average closed down more than 600 points. What was strange to Cramer, though, was that the U.S. market was down worse than the U.K. How the heck could that be possible if only a handful of Americans actually have significant exposure to the U.K.?

The first reason was that the market hates surprises, and this one was nasty. The night before, all numbers told Cramer that the market would be able to handle it. Yet, by the morning the futures were down big.

The bargains have yet to develop on a scale I find acceptable.Jim Cramer

Soon there was speculation of what country would be next to leave the EU.

"I think that's a bit of a straw man. Now that we see the impact in our faces, the pain that comes from the next exit vote will be entirely predictable, even if there is one, which I doubt," Cramer said.

The second reason was the issue of valuation. Prior to the Brexit vote, the average valuation of a stock in the was nearly 20 times earnings, yet the earnings weren't exactly stellar based on the companies that reported this week.

Third, one of the most bullish indicators of the market recently was that the dollar finally looked like it had peaked. That could allow U.S.-based companies with international exposure to report better earnings. But with European and financial turmoil, the pound fell a staggering 8 percent versus the dollar.

There is also a significant amount of money on the sidelines from investors who are genuinely repulsed by stocks. An event like this one doesn't exactly encourage them to put money back into stocks.

"I know that this is a market of stocks, not a stock market. I know that stocks do not all bottom at once. I know that each sell-off is different and ends in its own way. Valuing stocks is about putting a price on the underlying company's future earnings stream, the price to earnings multiple where you have to figure out what you're willing to pay for those future earnings," Cramer said.

Cramer liked the food and packaged goods companies, tech companies with great growth and domestic companies that won't get eaten by Amazon.

How does he value stocks?

By looking at the bond market. When there is stress in the system, investors tend to rush in to buy safety and will bid up bonds, which causes the yield to go down. Thus, he looks for stocks that are attractive as a bond market equivalent.

"Despite the big sell-off and one of the heftiest cash positions the trust has ever had, the bargains have yet to develop on a scale I find acceptable," Cramer said.

So, despite the sell-off on Friday and Cramer's eagerness to put money to work, he didn't. He anticipates that next week could bring an opportunity to buy high quality stocks at an even lower price.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com