U.S. stock index futures tumbled Friday as results from Thursday's referendum showed the U.K. had voted to leave the European Union (EU).

Dow Jones futures broke below an implied open down more than 700 points overnight, before paring losses to show an implied opening decline of about 500 points.

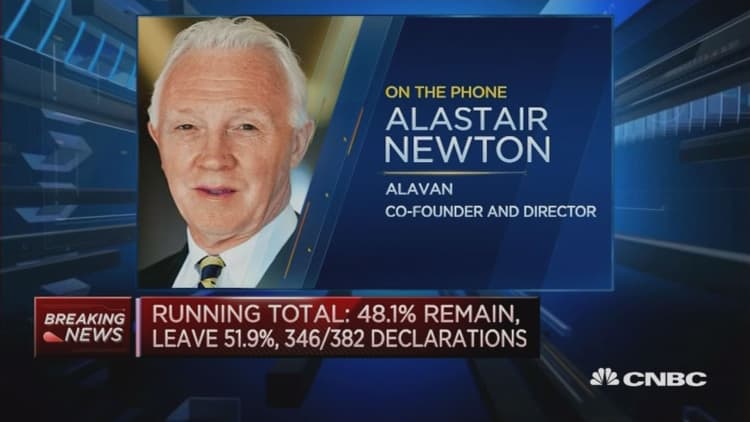

The referendum result stunned markets, which had expected the U.K. to vote to remain in the EU. The leave camp secured 51.9 percent of the vote.

At around 3:30 a.m. ET, U.K. Prime Minister David Cameron, who campaigned for the remain vote, announced his intention to resign by October.

Read MoreFollow CNBC's coverage of Brexit here

The U.S. Securities and Exchange Commission's limit-down rule comes into effect when equity securities fall by 5 percent or more. This is designed to control market volatility by preventing trade in securities after large and sudden price moves.

Today's trading day is rotten and it is the worst day that I have seen in my career. Moves like these do not happen every day or even every decade.Naeem AslamChief Market Analyst, Think Forex

European markets

London's benchmark FTSE 100 stock index accelerated losses after it opened at 3 a.m. ET to trade as much as 7.9 percent lower, before trading about 5 percent lower. The French CAC traded more than 8 percent lower and the German DAX was down 7 percent.

The STOXX Europe 600 Banks index traded more than 14 percent lower to more than 40 percent below its 52-week intraday high. The worst day for the index in history going back to 1987 was a 10.39 percent decline in October 2008.

"It is important to keep things in perspective, but in the short-term, we need to brace ourselves for more volatility," Andrew Sentance, senior economic adviser at PwC, said in a note on Friday.

Read MoreSee all US pre-market data here

Sterling fell as much as 10 percent against the U.S. dollar early on Friday, before paring some losses to trade 6 percent lower at $1.3695.

A bid for "safe-haven" assets early on Friday saw 10-year U.S. Treasury note yields hit a low of 1.406 percent, its lowest since July 26, 2012. The yield recovered to near 1.49 percent as of 6:57 a.m. ET.

The hit a low of 0.499 percent, its lowest level since April 17, 2015.

Spot gold prices rose about 5 percent to near $1,327 an ounce, after earlier hitting its highest in more than 2 years.

Brent and WTI crude futures for August fell about 5 percent, to around $48.28 a barrel and $47.63, respectively.

U.S. stocks closed more than 1 percent higher on Thursday, with the pound near year-to-date highs against the dollar, as expectations rose that the U.K. would vote to remain in the EU.