Falling oil prices saved Americans hundreds of dollars at the gas pump in 2015, and a lot of them spent those savings … at the gas station.

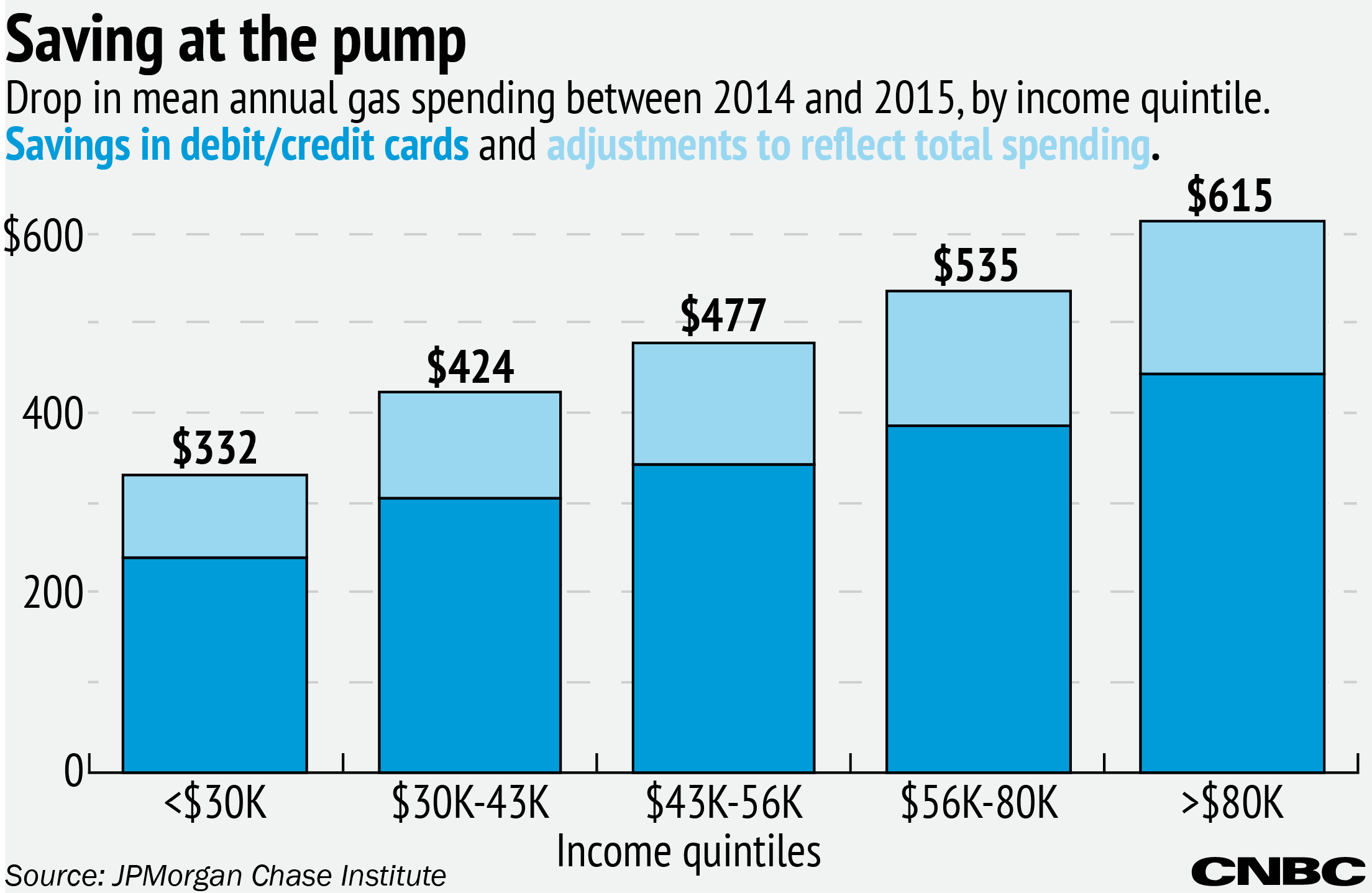

Middle-income households saved an average of $477 through the year, thanks to gas prices that fell 28 percent from 2014. The biggest business winners of the gas-price windfall were restaurants and retailers, both of which saw their share of consumers' budgets increase. The data come from a report by the JPMorgan Chase Institute published Thursday.

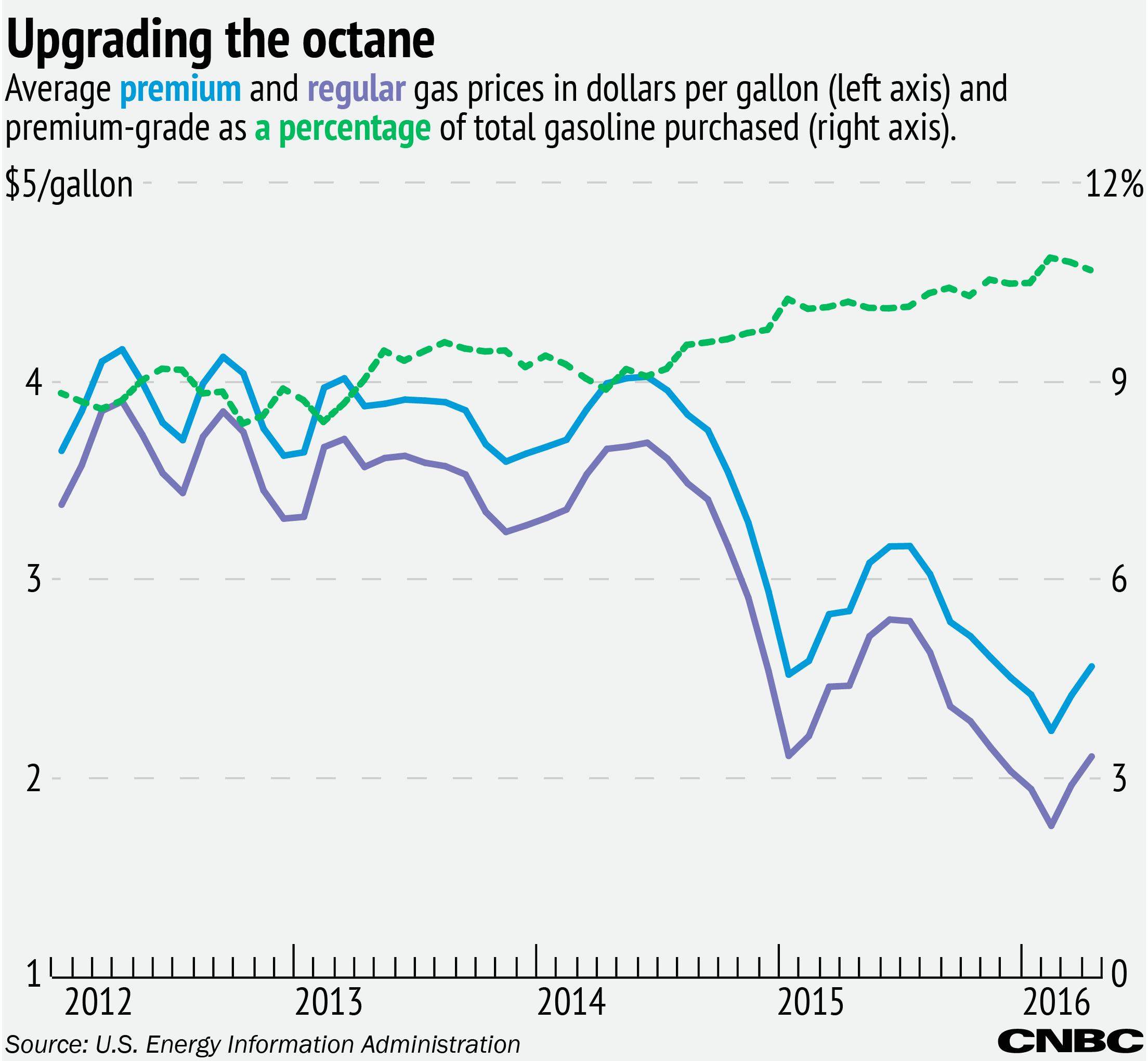

A big chunk of the gasoline savings — a full $155 — was spent right back at the gas station. Consumers bought more gas, higher-quality gas and snacks.

Researchers at the Chase Institute looked at the spending habits of 1 million Chase credit and debit card holders to assess the effects of falling gas prices on household budgets.

Thanks to dropping oil prices, a gallon of gas cost an average of $2.43 last year, compared with $3.36 in 2014, according to data from the U.S. Energy Information Administration. That decline in prices was the equivalent of a 1 percent increase in household income for a middle-income family (defined as those with incomes between $43,100 and $56,500).