European stocks finished with strong gains on Monday after the index posted an all-time record high shortly after Wall Street opened.

BMPS closes up 7%

European markets

The pan-European STOXX 600 index closed 1.6 percent higher provisionally, with all sectors in positive territory.

One of the best performers on the STOXX 600 index was Banca Monte dei Paschi di Siena (BMPS), which closed 7 percent higher on expectations that it will sell a big portion of its non-performing loan portfolio to the Italian bank rescue fund, Atlante, Reuters reported.

Thyssenkrupp also jumped as much as 6 percent, after the German steelmaker confirmed on Sunday that it was in talks with India's Tata Steel about a consolidation of beleaguered European steel mills.

The best-performing sector was basic resources stocks, closing 4 percent higher, as metal prices rose. Shares of miner Glencore closed up around 6 percent and steel giant ArcelorMittal popped as much as 5.6 percent.

Anglo American jumped above 8.5 percent, after Citigroup raised its target price on the stock.

More Abenomics?

Market sentiment around the world was buoyed by Friday's jobs data from the U.S. The widely eyed U.S. non-farm payrolls showed 287,000 jobs were created in June, beating expectations. The unemployment rate read 4.9 percent, also better than forecast.

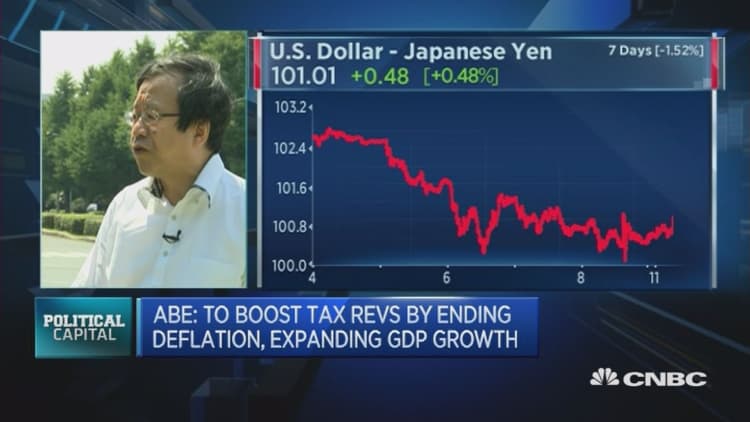

Plus, markets were boosted by a landslide victory for Japan's ruling coalition in upper house elections. This makes it likelier Prime Minister Shinzo Abe will be able to push through further monetary easing measures. A stimulus package of at least 10 trillion yen ($97.9 billion) is expected.

Subsequently the U.S. benchmark hit a new all-time intraday high soon after Wall Street's open, breaking a previous record set on May 20, 2015.

Meanwhile in the U.K., David Cameron has announced he will stand down as U.K. prime minister on Wednesday this week. He will be succeeded as prime minister by Theresa May who will have the task of leading the country in Brexit negotiations with the EU.

Farnborough Airshow begins

Virgin Atlantic signed a deal to buy 12 of Airbus's biggest twin-engine model, the A350-1000, Reuters reported. Airbus beat Boeing to the scarce order for big jets, as economic and political uncertainties overshadow the Farnborough Airshow. Shares of the firm closed up around 2.4 percent.

Shares of a number of Britain's house-builders and banking stocks were sharply higher, with the two sectors highly volatile since the U.K.'s vote to quit the European Union. Property stocks Taylor Wimpey, Barratt Development and Persimmon all closed above 7 percent, while U.K. lenders, Barclays, RBS and Lloyds finished higher.

Meanwhile, Spanish wind turbine manufacturer Gamesa jumped over 6 percent, after Exane BNP Paribas raised its price target and rating on the stock.