Bank of England Governor Mark Carney denied allegations on Tuesday that the bank tried to frighten the British electorate into voting to remain in the European Union (EU) by using "phony forecasts and scare stories."

Carney was forced to defend a Bank of England report published in May that said quitting the EU was the biggest risk facing the U.K. and could force the economy into recession.

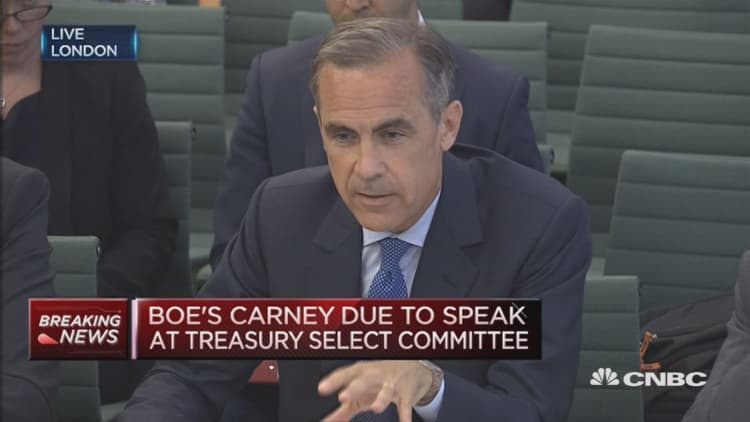

Speaking at a U.K. Treasury Committee hearing on Tuesday, he said the allegations against the Bank of England from two former U.K. Chancellors of the Exchequer and two ex-leaders of the Conservative Party were "extraordinary in all senses of the word."

"If we (the Bank of England) view something as the biggest risk, we have a statutory responsibility to make that clear," Carney told the committee.

"The assessment of financial stability in March … these are the assessments of the FPC (the Bank of England's Financial Policy Committee). It is an independent body. It is not based on whim, pre-judgment. It is based on analysis; robust debate; assessment. It is our duty to provide these assessments," he said separately.

Carney stands accused of violating the Bank of England's political independence by commenting on the likely economic outcome of the U.K. leaving the EU.

In June, four senior pro-Brexit Conservative veterans panned the Bank of England and other bodies for a "woeful failure" to provide balanced analysis of the potential outcome of Brexit.

"There has been startling dishonesty in the economic debate, with a woeful failure on the part of the Bank of England, the Treasury, and other official sources to present a fair and balanced analysis," Michael Howard and Iain Duncan Smith, both former Conservative leaders, and Nigel Lawson and Norman Lamont, former Conservative Chancellors, said in a letter published in The Telegraph.

"They have been peddling phony forecasts and scare stories to back up the attempts of David Cameron and George Osborne to frighten the electorate into voting remain," they added.

The U.K. voted to leave the EU by a narrow margin in a referendum at the end of last month. The result was unexpected and provoked global financial market tumult.

Carney said the Bank of England would have risked losing credibility if it had not warned on the dangers of Brexit before the vote.

"If you haven't identified risks, you (lack) credibility when you assert resilience … you can't govern by assertion. You can't wish things away. That way perpetuates a financial crisis," he told the Treasury Committee.

After the referendum, one leading Brexit campaigner, Boris Johnson, praised rather than criticized Carney.

"Most sensible people can see Bank of England Governor Mark Carney has done a superb job — and now that the referendum is over, he will be able to continue his work without being in the political firing-line," Johnson said in an article published in The Telegraph on June 26, before the farrago over Johnson's withdrawn candidacy to succeed David Cameron as Conservative leader.

European markets

Since the vote, trade in U.K. house building and banking stocks remains volatile, and further afield, the referendum spurred a renewed collapse in Italian bank shares as the broader market suffered. They are under fire for their still-heavy pile of non-performing loans — amounting to around 18 percent of their total loan stock, according to Carney.

He was questioned on Tuesday as to whether they posed a risk to the U.K. economy. Carney replied that while Italy's straits were serious, the U.K.'s vulnerability was relatively low. U.K. banks' direct exposure to Italian banks and the broader Italian economy stood at respectively sub- 1 percent and around 11 percent of their common equity, Carney said.

"The economic outlook (for Italy) is modest at this stage … There is likely to be required some form of recapitalization of some of these institutions," he told the Treasury Committee.