Netflix shares plummeted 14 percent on Tuesday, a day after the company reported slower-than-expected subscriber growth last quarter. But the streaming giant isn't the only company posting earnings this week where traders expect to see a big move.

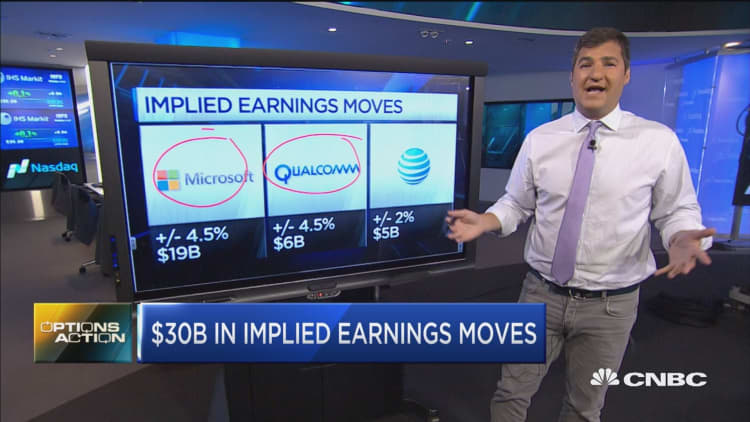

The options market is implying that Microsoft could have a potential 4.5 percent shift higher or lower when it releases earnings after the closing bell Tuesday. The stock was down roughly 1 percent ahead of that report.

Another tech giant that traders are expecting to see big action from is Qualcomm when it reports Wednesday afternoon. The implied move for the chipmaker is more than 4 percent in either direction. The company's shares are up more than 10 percent in 2016.

Meanwhile, traders are expecting one of this year's outperformers to post a bigger-than-expected move after earnings: AT&T. The options market is anticipating a 2 percent jolt for the stock, which is up more than 20 percent year to date.

Options traders calculate the implied move for equities by measuring a particular stock's so called straddle — or at the money put and call. The amount of the straddle typically captures market makers' expectations for how much a stock is going to move.

If the implied moves for Microsoft, Qualcomm and AT&T were to play out it could represent a potential $30 billion shift in market cap for the .