Pokémon Go may only be a few weeks old, but it's already had a significant impact on the market.

Nintendo -- the company behind the app -- has seen its market cap grow by $20 billion since the launch of the game.

While Nintendo works to ensure the game's longevity, and the company's competitors scramble to capitalize on augmented reality, one company stands to make a killing.

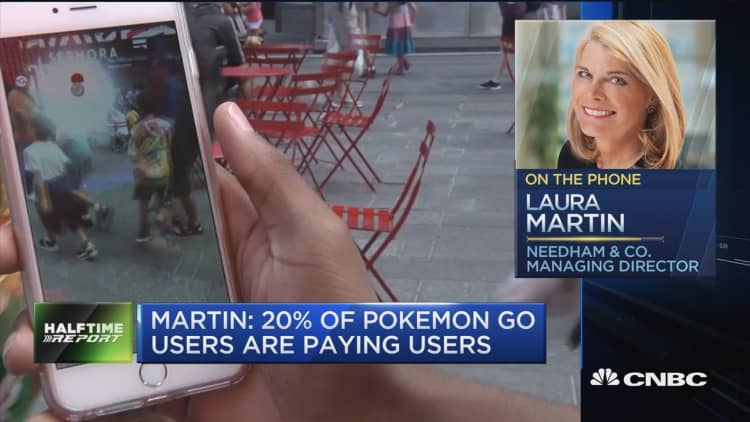

In a note out today, Needham analyst Laura Martin argues that Pokémon Go could add $3B to Apple's revenue.

Martin joined the "Halftime Report" to explain exactly how Pikachu will lift Apple's top line.

Underlying Martin's argument is her belief that Apple keeps 30% of revenue from all in-app purchases.

Martin looked at the impact of Candy Crush -- once the most popular gaming app -- on Apple as a comparable for how much the company stands to make from Pokémon Go.

According to Martin, Candy Crush generated "more than $1B of revenue in each of 2013 and 2014 and Pokémon Go's ratio of paid users to total users is 10X higher."

Since more Pokémon Go users pay for in-app purchases, the game could have a much greater impact on Apple's fundamentals than Candy Crush did.

Some investors may be concerned that the game will be short-lived since it targets attention-span starved millennials.

But Martin isn't worried about the possibility of fleeting success for Pokémon Go. Unlike Nintendo, which as the maker of the game faces intellectual property risks in the augmented reality space, Apple will likely also benefit from the next hit game.

"Apple is hedged because the next genius that makes a hit game, Apple shares in that one too. So while this one may be transitory, Apple has an option on all future hit games over the iOS platform."

But it isn't all fun and games for Apple.

Despite markets reaching record highs, the company has been under pressure this year. Apple is down 5% YTD as slumping iPhone sales and China market share concerns continue to weigh on the Cupertino-based company's bottom line.

But Martin -- who has a "strong buy" rating on the stock and a $150 price target -- believes these concerns are overblown.

She argues that by focusing so closely on Apple's iPhone sales, investors and analysts alike are valuing it as a hardware company. But Martin believes that's a fundamentally incorrect way to look at the company given its diverse ecosystem.

"Apple has higher profit margins than the Walt Disney Company, and it has higher returns on capital than Facebook. The notion that it should be valued as a hardware company just because it makes phones we think is flawed. Those margins are only achievable because it does have these ecosystem benefits like Pokémon Go that are much higher margin and much more long-term."

Only time will tell what impact the game will have on Apple's revenue. But for now, the hunt for Zubat continues.

Needham & Co. makes a market in Apple. Pete Najarian, Stephanie Link, Josh Brown, and Jim Lebenthal own Apple.