U.S crude futures settled down more than 2 percent at a three-month low on Wednesday after the U.S. government reported surprise builds in crude and gasoline inventories.

Prices held their losses after the Federal Reserve announced it would leave interest rate policy unchanged, though the central bank signaled its view of the economy had improved.

The oil and gas stockpile builds came despite the peak summer driving season as refiners cut production amid faltering demand and profits.

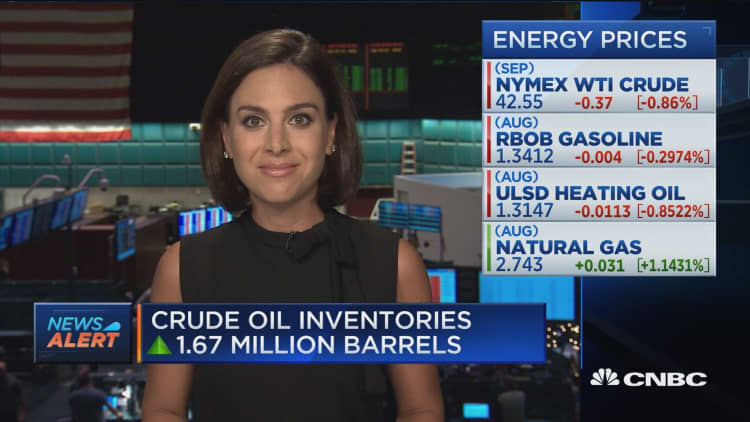

U.S. commercial crude in storage rose by 1.7 million barrels to a total of 521.1 million barrels in the week through July 22, the Energy Information Administration said. Analysts had expected a draw of 2.3 million barrels.

Gasoline stocks rose 452,000 barrels, compared with analysts' expectations for a 40,000-barrel increase.

Global benchmark Brent crude was on track for the first monthly loss since January and the largest of 2016. Futures traded down $1.32, or 2.9 percent, at $43.55 a barrel by 2:38 p.m. ET (1838 GMT).

U.S. West Texas Intermediate (WTI) crude settled down $1, or 2.3 percent, at $41.92 a barrel, having fallen to a three-month intraday low of $41.68.

Bart Melek, head of commodities strategy at TD Securities, told CNBC oil could be heading to its 200-day moving average at $40.76 per barrel.

"Technicals will seek a level around $40.38, then we'll see ... the fundamental outlook is much, much better than it was six months ago. We're still looking toward $60 for year end," he said.

He added that if $40 is broken, the next level would be just above $36.

Refinery crude runs fell 277,000 barrels per day last week as utilization rates fell 0.8 percentage point to 92.4 percent of capacity, the EIA data showed.

"A drop in refinery runs at the peak of summer driving season indicate refiners are dialing back amid faltering profit margins," said Matt Smith, analyst at New York-based oil cargoes tracker Clipperdata.

On Tuesday, the largest independent U.S. refiner Valero Energy said it expected lower refinery utilization over the rest of the year to counter slumping margins caused by record supplies of gasoline and diesel products.

BP's refining margins hit a six-year low in the second quarter and the oil major said margins would remain under significant pressure in the coming months.

"The bottom line is the street has gotten it wrong are far as the oil markets achieving supply-demand balance this year," said Tariq Zahir, crude trader and portfolio manager at Tyche Capital Advisors in New York.

"You need lower spot prices of crude and I believe you can only achieve by balance next year. We will likely break through the $40 levels in days and weeks to come."

Oil prices are still up more than 60 percent from 12-year lows of $26 to $27 in the first quarter. But the rally has faded since breaching $50 in May, amid worries oil may be headed for another glut.

Some market participants think the glut concerns are exaggerated.

"I think we will stay between $40 and $45," said Salvatore Recco, who helps oversee about $2 billion of client money, including in oil, at Gravity Investments in Denver, Colorado. "We'd only tell our customers to worry about the oil outlook when the central banks issue a serious downgrade to the economic outlook."

— CNBC's Tom DiChristopher and Patti Domm contributed to this report.