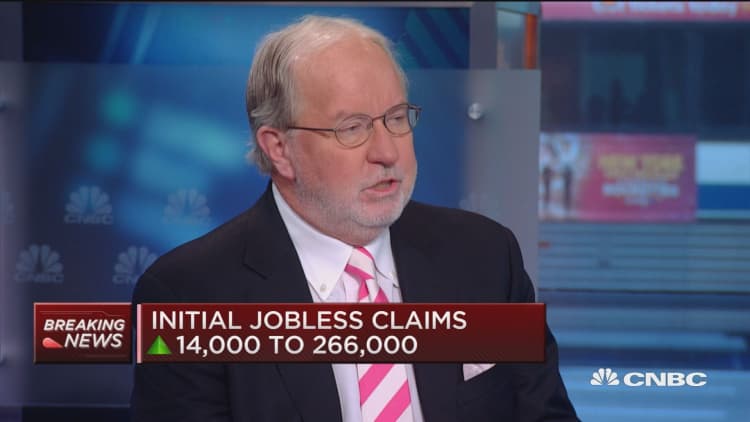

While the stock market and oil prices have been going up and down in tandem recently, historically they tend to move in opposite directions, closely followed market watcher Dennis Gartman said Thursday.

"The belief generally on the Street, 'As goes oil prices, so goes stock prices,' that's nonsense," said the founder and publisher of The Gartman Letter.

Over the "last five or six years," charts show crude going down and stock prices going up," he argued. "The correlation is negative, not positive."

Both stocks and U.S. crude bottomed for the year on Feb. 11, and for the most part continued to move higher together. West Texas Intermediate crude has surged more than 50 percent since then, while the S&P 500 has gained about 17 percent since its 2016 low.

"You had a period of about three or four months where they did in fact move in correlation with one and other. On balance over broad periods of time, the correlation is negative," Gartman said.

"If you did get crude oil [back] down to $35 then something is going on economically that's taking stock prices down," he said. "But it's not crude that's weighing upon stock prices, it will be economic activity that's weighing upon stock prices."